- India

- /

- Diversified Financial

- /

- NSEI:HUDCO

Housing and Urban Development Corporation Limited's (NSE:HUDCO) Shares Bounce 30% But Its Business Still Trails The Market

Housing and Urban Development Corporation Limited (NSE:HUDCO) shareholders have had their patience rewarded with a 30% share price jump in the last month. The last 30 days were the cherry on top of the stock's 364% gain in the last year, which is nothing short of spectacular.

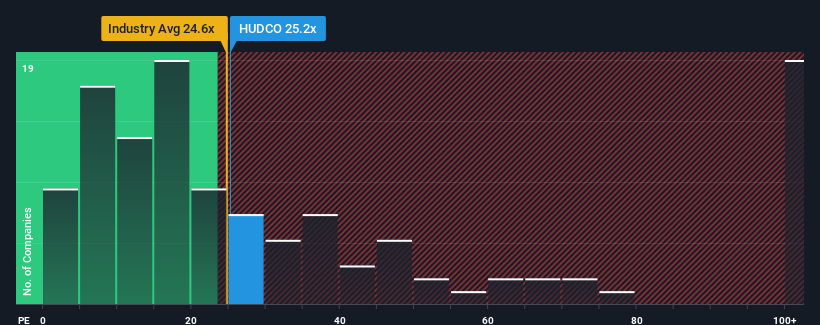

In spite of the firm bounce in price, given about half the companies in India have price-to-earnings ratios (or "P/E's") above 32x, you may still consider Housing and Urban Development as an attractive investment with its 25.2x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Earnings have risen firmly for Housing and Urban Development recently, which is pleasing to see. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

See our latest analysis for Housing and Urban Development

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Housing and Urban Development would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 14% last year. The latest three year period has also seen an excellent 38% overall rise in EPS, aided somewhat by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 25% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why Housing and Urban Development is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Bottom Line On Housing and Urban Development's P/E

The latest share price surge wasn't enough to lift Housing and Urban Development's P/E close to the market median. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Housing and Urban Development revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Housing and Urban Development (at least 1 which doesn't sit too well with us), and understanding them should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Housing and Urban Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HUDCO

Housing and Urban Development

Provides loans and financing for housing and urban development projects in India.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives