- India

- /

- Consumer Finance

- /

- NSEI:FIVESTAR

3 Indian Stocks With High Insider Ownership And 21% Revenue Growth

Reviewed by Simply Wall St

The Indian market has been flat in the last week but has seen a significant rise of 40% over the past 12 months, with earnings forecast to grow by 17% annually. In such an environment, companies that combine high insider ownership with strong revenue growth can be particularly appealing as they often signal confidence from those closest to the business and potential for continued expansion.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.4% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 30.8% |

| Paisalo Digital (BSE:532900) | 16.3% | 24.8% |

| Rajratan Global Wire (BSE:517522) | 18.3% | 35.8% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 32.3% |

| KEI Industries (BSE:517569) | 19.2% | 22.5% |

| Pricol (NSEI:PRICOLLTD) | 25.5% | 24% |

| Aether Industries (NSEI:AETHER) | 31.1% | 44.4% |

We're going to check out a few of the best picks from our screener tool.

Five-Star Business Finance (NSEI:FIVESTAR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Five-Star Business Finance Limited is a non-banking financial company in India with a market cap of ₹260.17 billion.

Operations: The company generates revenue from MSME Loans, Housing Loans, and Property Loans amounting to ₹17.79 billion.

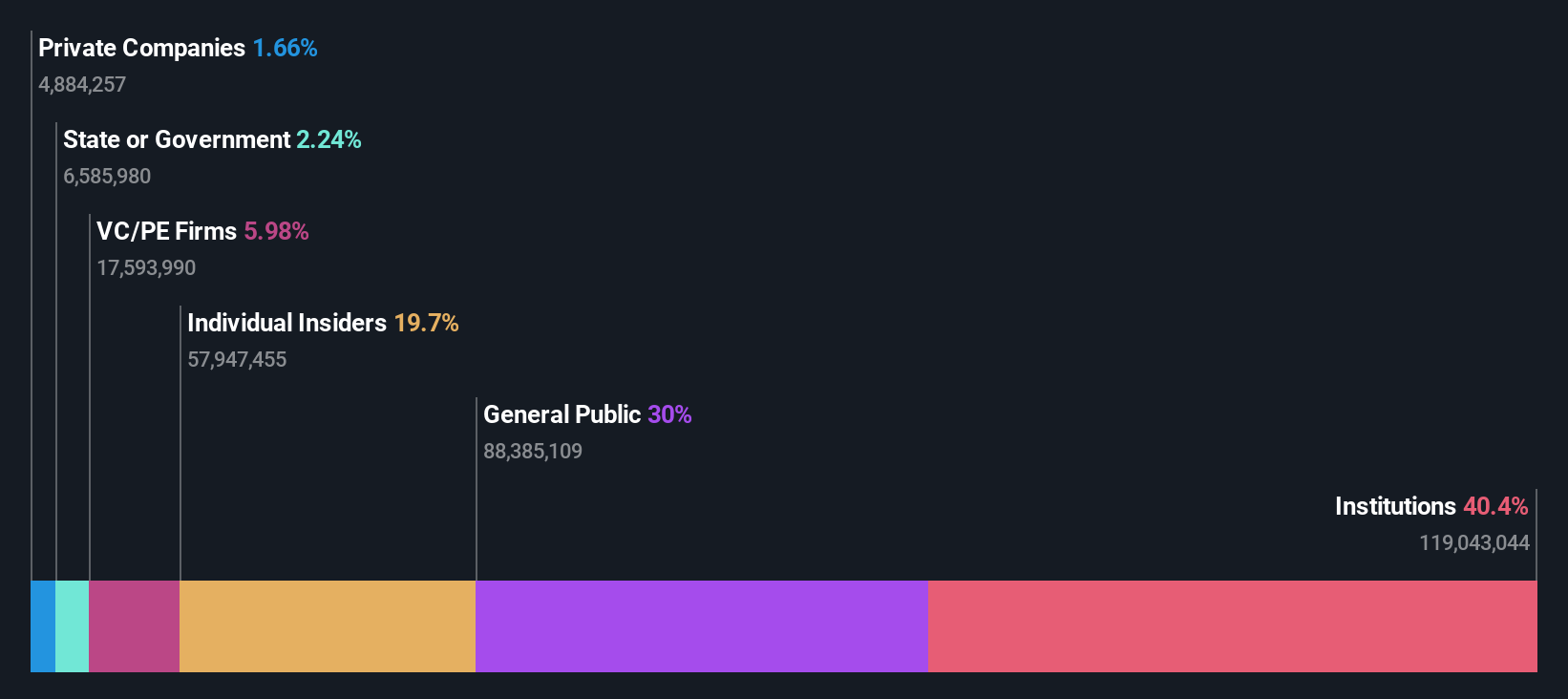

Insider Ownership: 18.7%

Revenue Growth Forecast: 21.9% p.a.

Five-Star Business Finance is poised for growth with earnings expected to rise 20.53% annually, outpacing the Indian market's 17.4%. Despite a low forecasted return on equity of 19.4%, its price-to-earnings ratio (28.8x) remains attractive compared to the market average of 34.1x. Recent board appointments and debt financing initiatives, including INR 25 billion in non-convertible debentures, suggest strategic positioning for expansion while maintaining substantial insider involvement through warrant allocations.

- Click here to discover the nuances of Five-Star Business Finance with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Five-Star Business Finance shares in the market.

Sansera Engineering (NSEI:SANSERA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sansera Engineering Limited manufactures and sells precision engineered components for automotive and non-automotive sectors across India, Europe, the United States, and internationally, with a market cap of ₹95.76 billion.

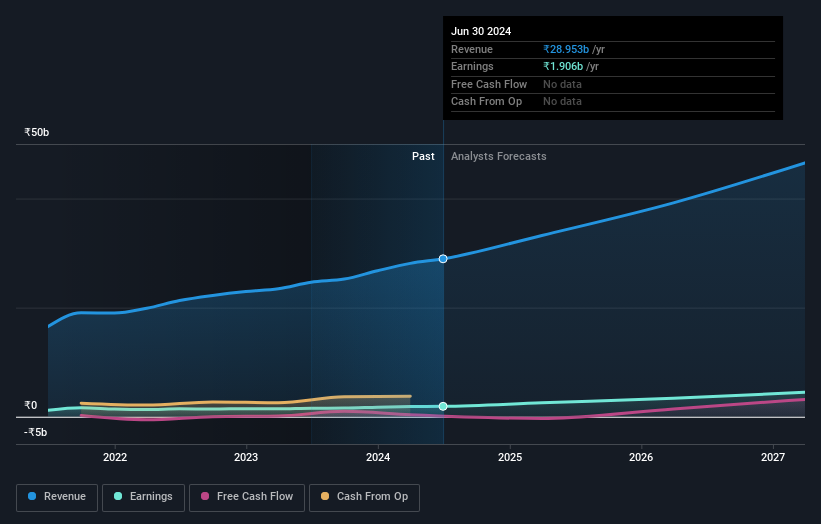

Operations: The company generates revenue of ₹28.95 billion from its precision-engineered components segment, catering to both automotive and non-automotive sectors worldwide.

Insider Ownership: 30.5%

Revenue Growth Forecast: 15.4% p.a.

Sansera Engineering's growth trajectory is underscored by its expected earnings increase of 29.3% annually, surpassing the broader Indian market. The recent long-term contract with Dynamatic Technologies for Airbus A220 components exemplifies its strategic expansion in aerospace manufacturing. Despite past shareholder dilution and high debt levels, Sansera's acquisition of industrial land in Karnataka signals robust future capacity growth. Insider ownership remains significant, reflecting confidence amidst these strategic developments and financial forecasts.

- Click here and access our complete growth analysis report to understand the dynamics of Sansera Engineering.

- Our valuation report here indicates Sansera Engineering may be overvalued.

VA Tech Wabag (NSEI:WABAG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: VA Tech Wabag Limited, with a market cap of ₹116.37 billion, specializes in the design, supply, installation, construction, operation, and maintenance of drinking water, waste and industrial water treatment, and desalination plants both in India and internationally.

Operations: The company's revenue primarily comes from the construction and maintenance of water treatment plants, amounting to ₹29.30 billion.

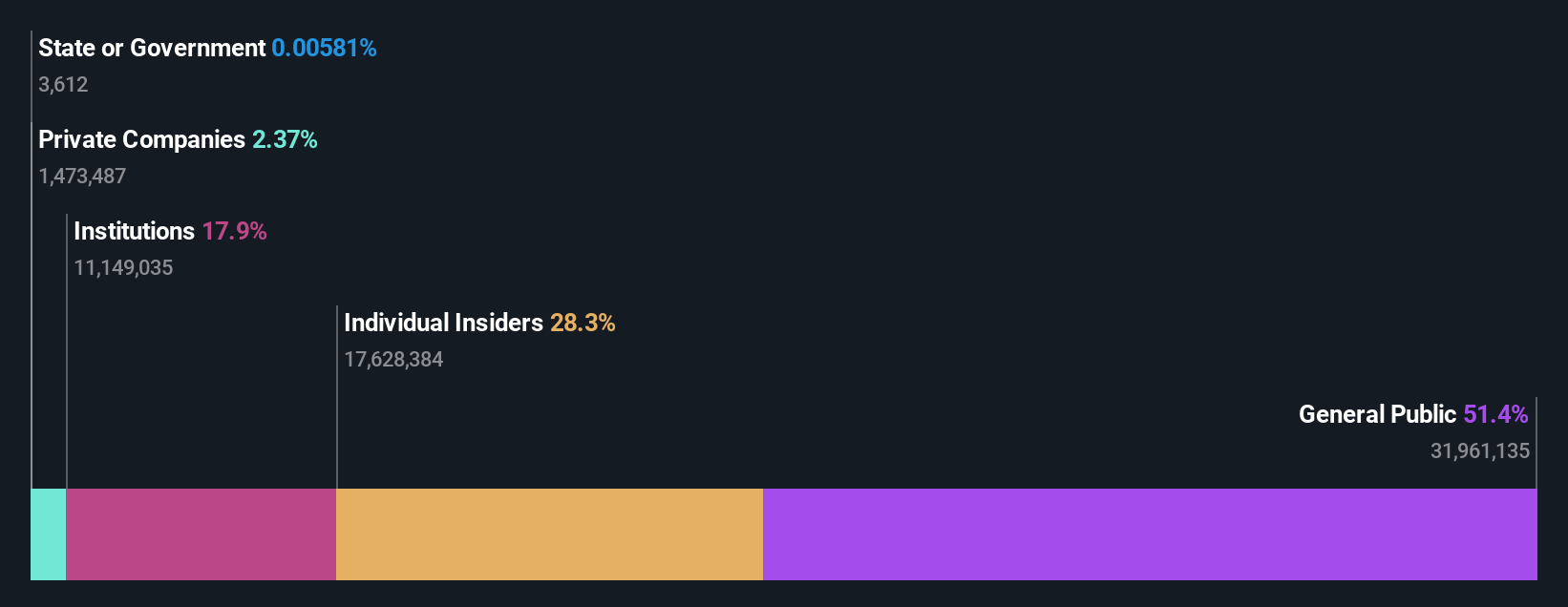

Insider Ownership: 28.3%

Revenue Growth Forecast: 17.4% p.a.

VA Tech Wabag is experiencing significant earnings growth, expected to rise by 27.3% annually, outpacing the Indian market. Recent major contracts in desalination and water treatment with Indosol Solar and Reliance Industries highlight its strategic expansion and leadership in these sectors. Despite no substantial insider buying recently, insider ownership remains influential. However, a legal dispute with Travancore Titanium Products poses potential financial challenges as the company plans to appeal an unfavorable arbitration award.

- Take a closer look at VA Tech Wabag's potential here in our earnings growth report.

- According our valuation report, there's an indication that VA Tech Wabag's share price might be on the expensive side.

Summing It All Up

- Embark on your investment journey to our 87 Fast Growing Indian Companies With High Insider Ownership selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Five-Star Business Finance, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:FIVESTAR

Five-Star Business Finance

Operates as a non-banking financial company in India.

Proven track record and fair value.

Market Insights

Community Narratives