- India

- /

- Consumer Finance

- /

- NSEI:EQUITAS

Here's Why I Think Equitas Holdings (NSE:EQUITAS) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Equitas Holdings (NSE:EQUITAS). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for Equitas Holdings

How Fast Is Equitas Holdings Growing Its Earnings Per Share?

Over the last three years, Equitas Holdings has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. Like a firecracker arcing through the night sky, Equitas Holdings's EPS shot from ₹6.75 to ₹12.32, over the last year. You don't see 82% year-on-year growth like that, very often.

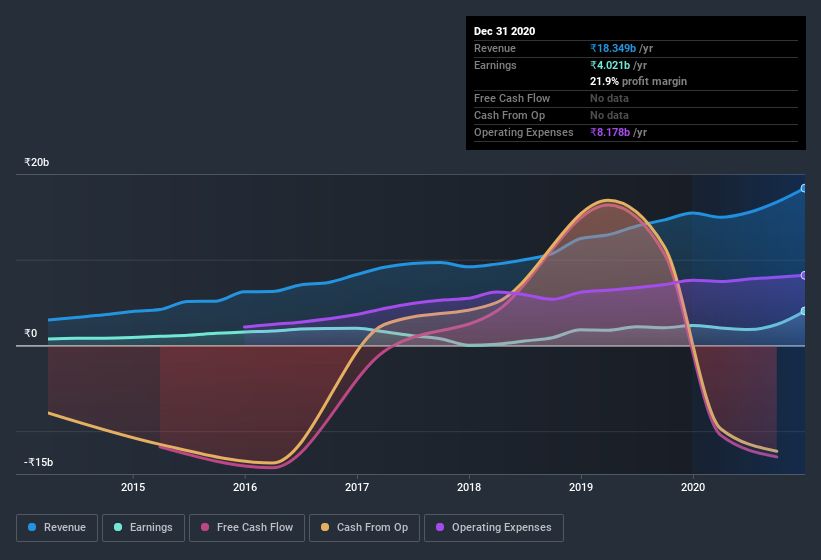

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. I note that Equitas Holdings's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note Equitas Holdings's EBIT margins were flat over the last year, revenue grew by a solid 19% to ₹18b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Equitas Holdings.

Are Equitas Holdings Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news for Equitas Holdings shareholders is that no insiders reported selling shares in the last year. With that in mind, it's heartening that Tabassum Inamdar, the of the company, paid ₹3.1m for shares at around ₹88.96 each.

Along with the insider buying, another encouraging sign for Equitas Holdings is that insiders, as a group, have a considerable shareholding. To be specific, they have ₹2.5b worth of shares. That's a lot of money, and no small incentive to work hard. That amounts to 7.5% of the company, demonstrating a degree of high-level alignment with shareholders.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. The cherry on top is that the CEO, A. Alex is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalizations between ₹15b and ₹59b, like Equitas Holdings, the median CEO pay is around ₹25m.

The CEO of Equitas Holdings only received ₹5.7m in total compensation for the year ending . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Does Equitas Holdings Deserve A Spot On Your Watchlist?

Equitas Holdings's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Equitas Holdings deserves timely attention. We don't want to rain on the parade too much, but we did also find 4 warning signs for Equitas Holdings (1 is a bit concerning!) that you need to be mindful of.

The good news is that Equitas Holdings is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Equitas Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Equitas Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:EQUITAS

Equitas Holdings

Equitas Holdings Limited, through its subsidiaries, operates as a non-banking financial institution in India.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives