Crest Ventures Limited's (NSE:CREST) investors are due to receive a payment of ₹1.00 per share on 30th of September. This means the annual payment will be 0.3% of the current stock price, which is lower than the industry average.

Check out our latest analysis for Crest Ventures

Crest Ventures' Payment Has Solid Earnings Coverage

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. Crest Ventures is quite easily earning enough to cover the dividend, however it is being let down by weak cash flows. With the company not bringing in any cash, paying out to shareholders is bound to become difficult at some point.

Looking forward, earnings per share could rise by 4.5% over the next year if the trend from the last few years continues. If the dividend continues along recent trends, we estimate the payout ratio will be 4.5%, which is in the range that makes us comfortable with the sustainability of the dividend.

Crest Ventures Has A Solid Track Record

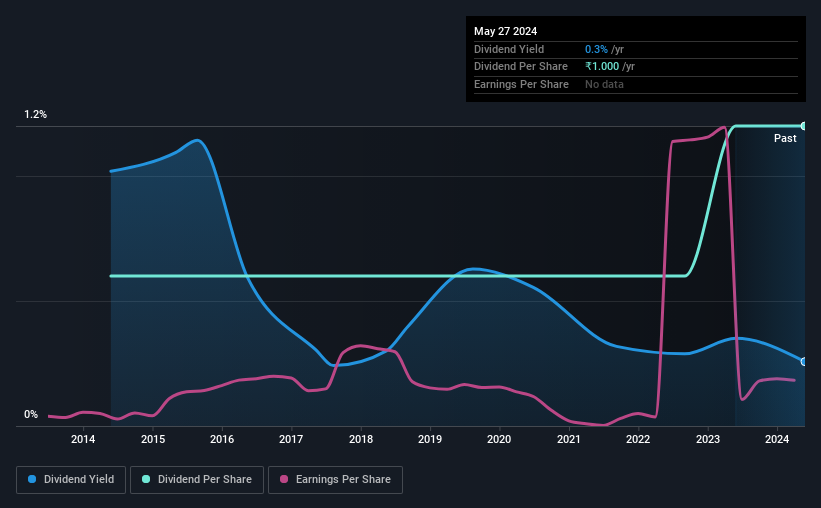

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. Since 2014, the annual payment back then was ₹0.50, compared to the most recent full-year payment of ₹1.00. This means that it has been growing its distributions at 7.2% per annum over that time. Companies like this can be very valuable over the long term, if the decent rate of growth can be maintained.

The Dividend's Growth Prospects Are Limited

Investors could be attracted to the stock based on the quality of its payment history. Earnings has been rising at 4.5% per annum over the last five years, which admittedly is a bit slow. If Crest Ventures is struggling to find viable investments, it always has the option to increase its payout ratio to pay more to shareholders.

In Summary

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. While the low payout ratio is a redeeming feature, this is offset by the minimal cash to cover the payments. We would be a touch cautious of relying on this stock primarily for the dividend income.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 1 warning sign for Crest Ventures that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CREST

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives