- India

- /

- Consumer Finance

- /

- NSEI:CGCL

Shareholders of Capri Global Capital (NSE:CGCL) Must Be Delighted With Their 760% Total Return

For many, the main point of investing in the stock market is to achieve spectacular returns. And we've seen some truly amazing gains over the years. To wit, the Capri Global Capital Limited (NSE:CGCL) share price has soared 740% over five years. And this is just one example of the epic gains achieved by some long term investors. Also pleasing for shareholders was the 37% gain in the last three months. But this could be related to the strong market, which is up 22% in the last three months.

Anyone who held for that rewarding ride would probably be keen to talk about it.

See our latest analysis for Capri Global Capital

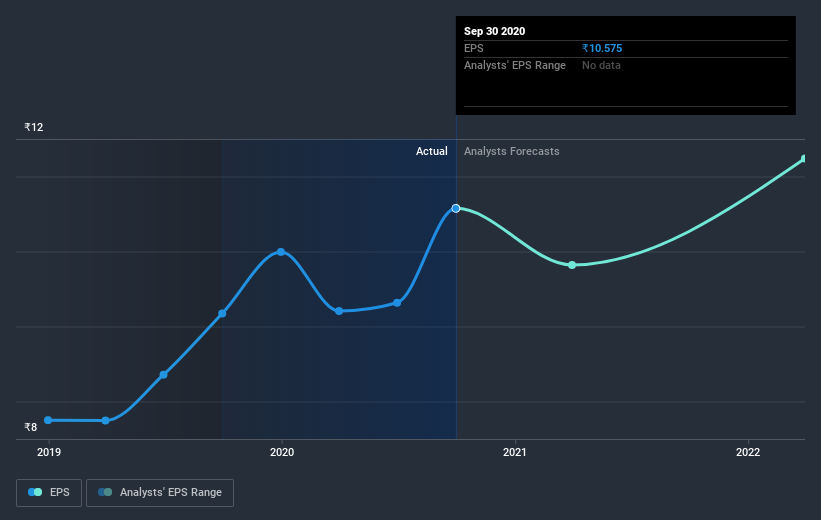

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over half a decade, Capri Global Capital managed to grow its earnings per share at 15% a year. This EPS growth is slower than the share price growth of 53% per year, over the same period. This suggests that market participants hold the company in higher regard, these days. And that's hardly shocking given the track record of growth.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Capri Global Capital the TSR over the last 5 years was 760%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're pleased to report that Capri Global Capital shareholders have received a total shareholder return of 52% over one year. And that does include the dividend. Having said that, the five-year TSR of 54% a year, is even better. It's always interesting to track share price performance over the longer term. But to understand Capri Global Capital better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Capri Global Capital you should be aware of, and 1 of them is a bit unpleasant.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you’re looking to trade Capri Global Capital, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:CGCL

Capri Global Capital

A non-banking financial company, provides financial services in India.

High growth potential with proven track record.