- India

- /

- Capital Markets

- /

- NSEI:CENTRUM

Centrum Capital's (NSE:CENTRUM) Stock Price Has Reduced 36% In The Past Year

While it may not be enough for some shareholders, we think it is good to see the Centrum Capital Limited (NSE:CENTRUM) share price up 22% in a single quarter. But that is minimal compensation for the share price under-performance over the last year. The cold reality is that the stock has dropped 36% in one year, under-performing the market.

Check out our latest analysis for Centrum Capital

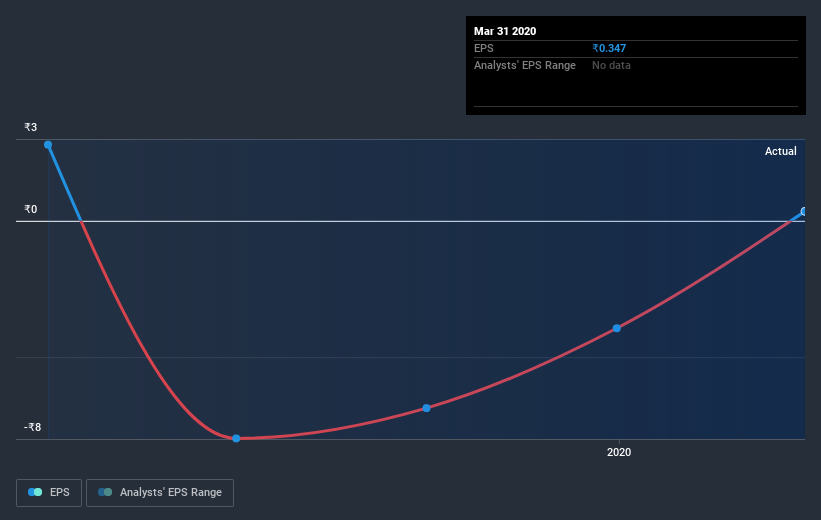

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Centrum Capital managed to increase earnings per share from a loss to a profit, over the last 12 months.

We're surprised that the share price is lower given that improvement. If the improved profitability is a sign of things to come, then right now may prove the perfect time to pop this stock on your watchlist.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It might be well worthwhile taking a look at our free report on Centrum Capital's earnings, revenue and cash flow.

A Different Perspective

While Centrum Capital shareholders are down 36% for the year, the market itself is up 6.9%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Putting aside the last twelve months, it's good to see the share price has rebounded by 22%, in the last ninety days. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). It's always interesting to track share price performance over the longer term. But to understand Centrum Capital better, we need to consider many other factors. Take risks, for example - Centrum Capital has 4 warning signs (and 1 which is a bit concerning) we think you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

When trading Centrum Capital or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:CENTRUM

Centrum Capital

Provides various financial services for institutions and individuals in India and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives