- India

- /

- Capital Markets

- /

- NSEI:CDSL

With EPS Growth And More, Central Depository Services (India) (NSE:CDSL) Makes An Interesting Case

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Central Depository Services (India) (NSE:CDSL), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Central Depository Services (India) with the means to add long-term value to shareholders.

View our latest analysis for Central Depository Services (India)

Central Depository Services (India)'s Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. Central Depository Services (India)'s shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 40%. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

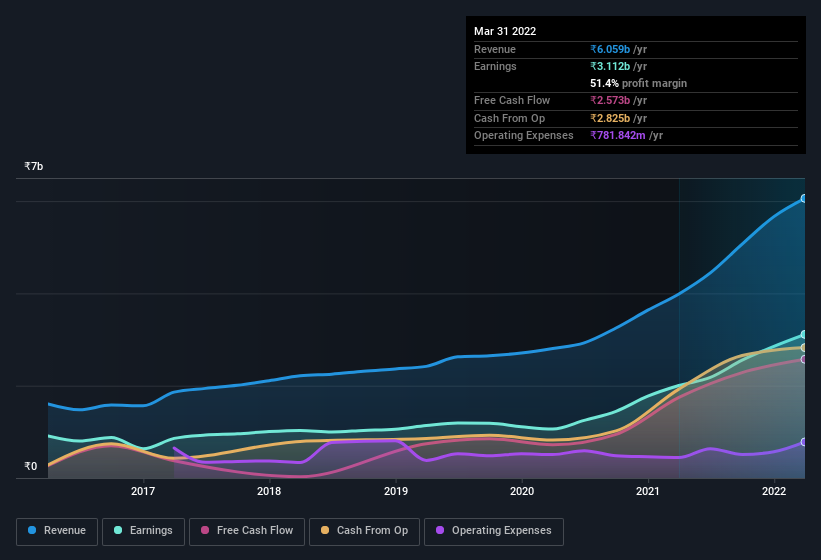

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Our analysis has highlighted that Central Depository Services (India)'s revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. EBIT margins for Central Depository Services (India) remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 52% to ₹6.1b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Central Depository Services (India).

Are Central Depository Services (India) Insiders Aligned With All Shareholders?

It's a good habit to check into a company's remuneration policies to ensure that the CEO and management team aren't putting their own interests before that of the shareholder with excessive salary packages. The median total compensation for CEOs of companies similar in size to Central Depository Services (India), with market caps between ₹80b and ₹256b, is around ₹41m.

Central Depository Services (India)'s CEO took home a total compensation package worth ₹22m in the year leading up to March 2021. That comes in below the average for similar sized companies and seems pretty reasonable. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Is Central Depository Services (India) Worth Keeping An Eye On?

Central Depository Services (India)'s earnings per share growth have been climbing higher at an appreciable rate. Such fast EPS growth prompts the question: has the business reached an inflection point? At the same time the reasonable CEO compensation reflects well on the board of directors. It will definitely require further research to be sure, but it does seem that Central Depository Services (India) has the hallmarks of a quality business; and that would make it well worth watching. You should always think about risks though. Case in point, we've spotted 2 warning signs for Central Depository Services (India) you should be aware of, and 1 of them can't be ignored.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CDSL

Central Depository Services (India)

Provides depository services in India.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives