- India

- /

- Capital Markets

- /

- NSEI:CDSL

Brokers Are Upgrading Their Views On Central Depository Services (India) Limited (NSE:CDSL) With These New Forecasts

Celebrations may be in order for Central Depository Services (India) Limited (NSE:CDSL) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. Consensus estimates suggest investors could expect greatly increased statutory revenues and earnings per share, with analysts modelling a real improvement in business performance.

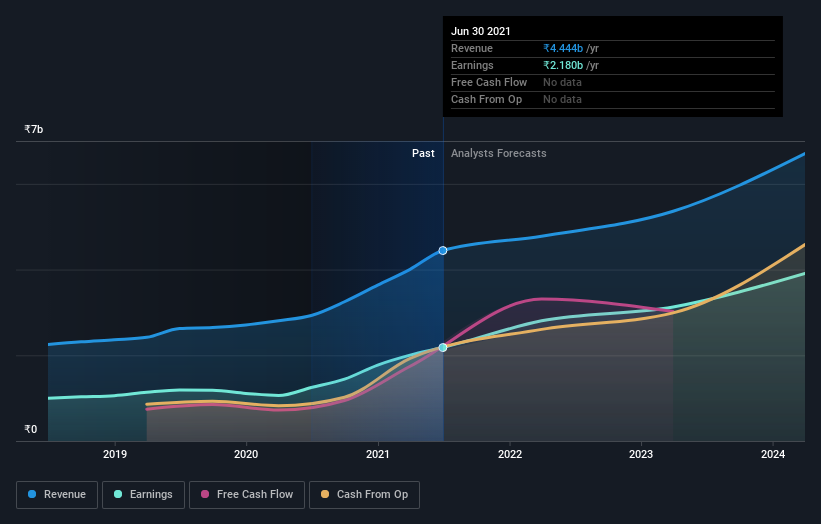

After this upgrade, Central Depository Services (India)'s four analysts are now forecasting revenues of ₹4.8b in 2022. This would be an okay 7.6% improvement in sales compared to the last 12 months. Statutory earnings per share are presumed to shoot up 22% to ₹25.44. Before this latest update, the analysts had been forecasting revenues of ₹4.0b and earnings per share (EPS) of ₹22.58 in 2022. There has definitely been an improvement in perception recently, with the analysts substantially increasing both their earnings and revenue estimates.

See our latest analysis for Central Depository Services (India)

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. We would highlight that Central Depository Services (India)'s revenue growth is expected to slow, with the forecast 10% annualised growth rate until the end of 2022 being well below the historical 19% p.a. growth over the last five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 7.6% annually. So it's pretty clear that, while Central Depository Services (India)'s revenue growth is expected to slow, it's still expected to grow faster than the industry itself.

The Bottom Line

The most important thing to take away from this upgrade is that analysts upgraded their earnings per share estimates for this year, expecting improving business conditions. They also upgraded their revenue estimates for this year, and sales are expected to grow faster than the wider market. The clear improvement in sentiment should be enough to get most shareholders feeling more optimistic about Central Depository Services (India)'s future.

Still, the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple Central Depository Services (India) analysts - going out to 2024, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you’re looking to trade Central Depository Services (India), open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:CDSL

Central Depository Services (India)

Provides depository services in India.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026