- India

- /

- Diversified Financial

- /

- NSEI:CANFINHOME

Can Fin Homes (NSE:CANFINHOME) Ticks All The Boxes When It Comes To Earnings Growth

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Can Fin Homes (NSE:CANFINHOME). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Can Fin Homes' Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. It certainly is nice to see that Can Fin Homes has managed to grow EPS by 19% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. It's noted that Can Fin Homes' revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. Can Fin Homes maintained stable EBIT margins over the last year, all while growing revenue 9.1% to ₹14b. That's encouraging news for the company!

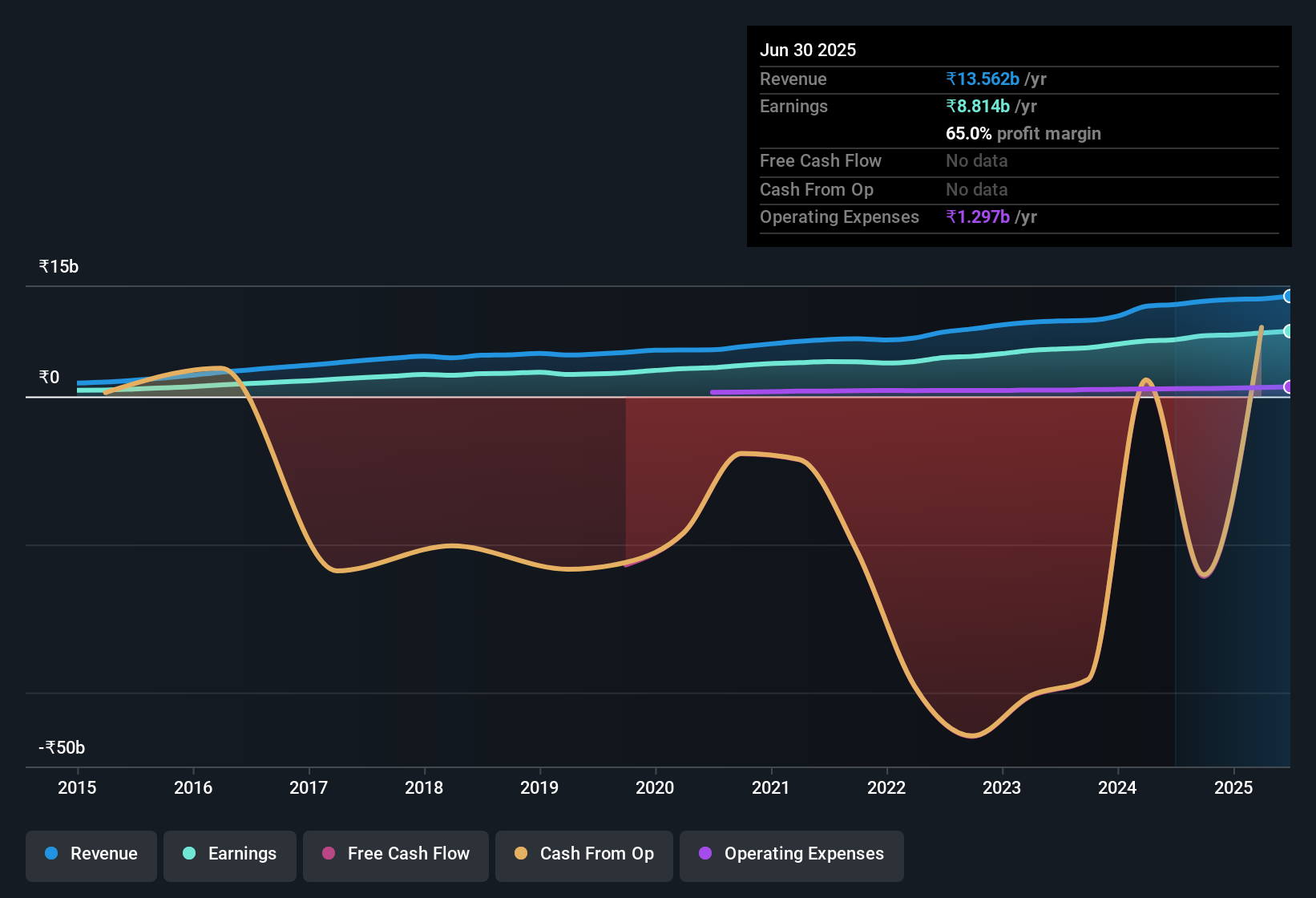

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

View our latest analysis for Can Fin Homes

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Can Fin Homes' forecast profits?

Are Can Fin Homes Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. The median total compensation for CEOs of companies similar in size to Can Fin Homes, with market caps between ₹36b and ₹142b, is around ₹36m.

Can Fin Homes' CEO took home a total compensation package worth ₹20m in the year leading up to March 2025. That comes in below the average for similar sized companies and seems pretty reasonable. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Should You Add Can Fin Homes To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Can Fin Homes' strong EPS growth. With swiftly growing earnings, the best days may still be to come, and the modest CEO pay suggests the company is careful with cash. So this stock is well worth an addition to your watchlist as it has the potential to provide great value to shareholders. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Can Fin Homes , and understanding it should be part of your investment process.

Although Can Fin Homes certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Indian companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CANFINHOME

Can Fin Homes

Provides housing finance services primarily to first-time homebuyers and professionals in India.

6 star dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives