- India

- /

- Consumer Finance

- /

- NSEI:BAJFINANCE

Potential Upside For Bajaj Finance Limited (NSE:BAJFINANCE) Not Without Risk

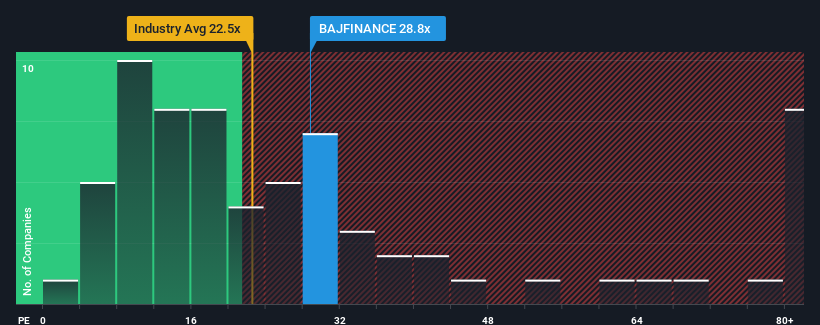

With a median price-to-earnings (or "P/E") ratio of close to 32x in India, you could be forgiven for feeling indifferent about Bajaj Finance Limited's (NSE:BAJFINANCE) P/E ratio of 28.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

There hasn't been much to differentiate Bajaj Finance's and the market's earnings growth lately. The P/E is probably moderate because investors think this modest earnings performance will continue. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

Check out our latest analysis for Bajaj Finance

How Is Bajaj Finance's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Bajaj Finance's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 24% last year. Pleasingly, EPS has also lifted 218% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 30% per year during the coming three years according to the analysts following the company. With the market only predicted to deliver 20% each year, the company is positioned for a stronger earnings result.

In light of this, it's curious that Bajaj Finance's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Bajaj Finance currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Having said that, be aware Bajaj Finance is showing 5 warning signs in our investment analysis, and 2 of those shouldn't be ignored.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Bajaj Finance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BAJFINANCE

Bajaj Finance

Operates as a deposit-taking non-banking financial company in India.

Exceptional growth potential average dividend payer.

Market Insights

Community Narratives