- India

- /

- Diversified Financial

- /

- NSEI:ABCAPITAL

Is Now The Time To Put Aditya Birla Capital (NSE:ABCAPITAL) On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Aditya Birla Capital (NSE:ABCAPITAL). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Aditya Birla Capital

How Quickly Is Aditya Birla Capital Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. We can see that in the last three years Aditya Birla Capital grew its EPS by 8.8% per year. That growth rate is fairly good, assuming the company can keep it up.

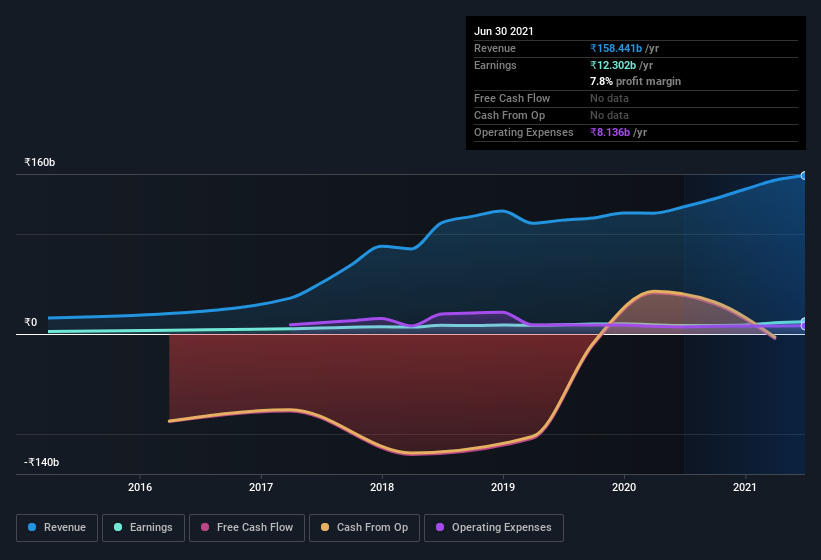

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). I note that Aditya Birla Capital's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note Aditya Birla Capital's EBIT margins were flat over the last year, revenue grew by a solid 25% to ₹158b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future Aditya Birla Capital EPS 100% free.

Are Aditya Birla Capital Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. As a result, I'm encouraged by the fact that insiders own Aditya Birla Capital shares worth a considerable sum. As a group insiders own shares currently valued at ₹1.1b, which amounts to 0.4% of the business. That is a valuable holding, but it's worth noting the CEO has a took home a ₹273m salary in the year to .

Is Aditya Birla Capital Worth Keeping An Eye On?

One important encouraging feature of Aditya Birla Capital is that it is growing profits. If that's not enough on its own, there is also the rather notable levels of insider ownership. The combination sparks joy for me, so I'd consider keeping the company on a watchlist. You still need to take note of risks, for example - Aditya Birla Capital has 2 warning signs (and 1 which is potentially serious) we think you should know about.

Although Aditya Birla Capital certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:ABCAPITAL

Aditya Birla Capital

Through its subsidiaries, provides various financial products and services in India and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives