- India

- /

- Hospitality

- /

- NSEI:LEMONTREE

These Analysts Just Made A Substantial Downgrade To Their Lemon Tree Hotels Limited (NSE:LEMONTREE) EPS Forecasts

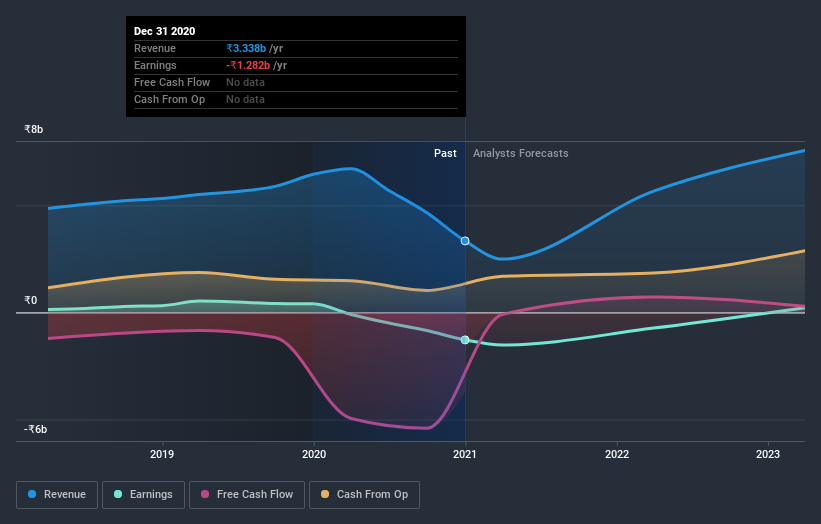

The latest analyst coverage could presage a bad day for Lemon Tree Hotels Limited (NSE:LEMONTREE), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. Revenue and earnings per share (EPS) forecasts were both revised downwards, with analysts seeing grey clouds on the horizon.

Following the downgrade, the most recent consensus for Lemon Tree Hotels from its ten analysts is for revenues of ₹5.7b in 2022 which, if met, would be a sizeable 70% increase on its sales over the past 12 months. The loss per share is anticipated to greatly reduce in the near future, narrowing 44% to ₹0.89. However, before this estimates update, the consensus had been expecting revenues of ₹6.5b and ₹0.69 per share in losses. Ergo, there's been a clear change in sentiment, with the analysts administering a notable cut to next year's revenue estimates, while at the same time increasing their loss per share forecasts.

See our latest analysis for Lemon Tree Hotels

Analysts lifted their price target 18% to ₹39.73, implicitly signalling that lower earnings per share are not expected to have a longer-term impact on the stock's value. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. Currently, the most bullish analyst values Lemon Tree Hotels at ₹50.00 per share, while the most bearish prices it at ₹23.00. This is a fairly broad spread of estimates, suggesting that the analysts are forecasting a wide range of possible outcomes for the business.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Lemon Tree Hotels' past performance and to peers in the same industry. It's clear from the latest estimates that Lemon Tree Hotels' rate of growth is expected to accelerate meaningfully, with the forecast 70% revenue growth noticeably faster than its historical growth of 5.3% p.a. over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 33% next year. Factoring in the forecast acceleration in revenue, it's pretty clear that Lemon Tree Hotels is expected to grow much faster than its industry.

The Bottom Line

The most important thing to note from this downgrade is that the consensus increased its forecast losses next year, suggesting all may not be well at Lemon Tree Hotels. While analysts did downgrade their revenue estimates, these forecasts still imply revenues will perform better than the wider market. The increasing price target is not intuitively what we would expect to see, given these downgrades, and we'd suggest shareholders revisit their investment thesis before making a decision.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. At Simply Wall St, we have a full range of analyst estimates for Lemon Tree Hotels going out to 2023, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

When trading Lemon Tree Hotels or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:LEMONTREE

Lemon Tree Hotels

Owns and operates a chain of business and leisure hotels.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives