Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Eternal Limited (NSE:ETERNAL) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

What Is Eternal's Net Debt?

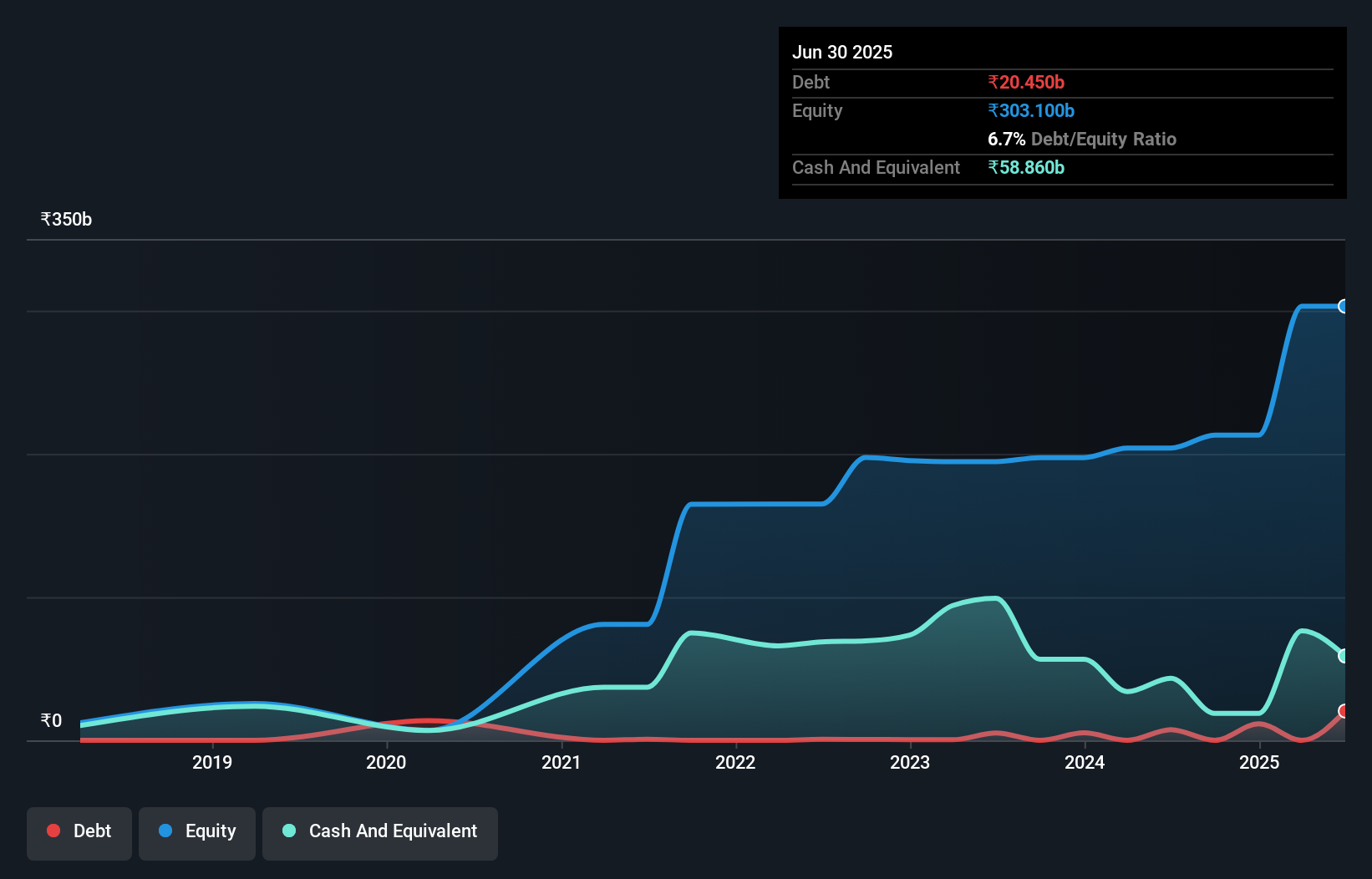

As you can see below, at the end of March 2025, Eternal had ₹20.5b of debt, up from ₹7.49b a year ago. Click the image for more detail. But it also has ₹58.9b in cash to offset that, meaning it has ₹38.4b net cash.

How Healthy Is Eternal's Balance Sheet?

We can see from the most recent balance sheet that Eternal had liabilities of ₹33.3b falling due within a year, and liabilities of ₹19.9b due beyond that. Offsetting these obligations, it had cash of ₹58.9b as well as receivables valued at ₹28.6b due within 12 months. So it actually has ₹34.3b more liquid assets than total liabilities.

Having regard to Eternal's size, it seems that its liquid assets are well balanced with its total liabilities. So while it's hard to imagine that the ₹2.88t company is struggling for cash, we still think it's worth monitoring its balance sheet. Succinctly put, Eternal boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Eternal can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

View our latest analysis for Eternal

Over 12 months, Eternal reported revenue of ₹232b, which is a gain of 67%, although it did not report any earnings before interest and tax. Shareholders probably have their fingers crossed that it can grow its way to profits.

So How Risky Is Eternal?

Although Eternal had an earnings before interest and tax (EBIT) loss over the last twelve months, it made a statutory profit of ₹3.0b. So taking that on face value, and considering the cash, we don't think its very risky in the near term. Keeping in mind its 67% revenue growth over the last year, we think there's a decent chance the company is on track. We'd see further strong growth as an optimistic indication. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 1 warning sign for Eternal you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Eternal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ETERNAL

Eternal

Provides e-commerce platform services to restaurant partners, quick commerce merchants, delivery partners, theatres, and event organisers in India and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026