- India

- /

- Hospitality

- /

- NSEI:EIHAHOTELS

EIH Associated Hotels' (NSE:EIHAHOTELS) Stock Price Has Reduced 33% In The Past Three Years

EIH Associated Hotels Limited (NSE:EIHAHOTELS) shareholders should be happy to see the share price up 10% in the last month. But that cannot eclipse the less-than-impressive returns over the last three years. After all, the share price is down 33% in the last three years, significantly under-performing the market.

View our latest analysis for EIH Associated Hotels

Given that EIH Associated Hotels only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Over the last three years, EIH Associated Hotels' revenue dropped 8.0% per year. That is not a good result. The stock has disappointed holders over the last three years, falling 10%, annualized. That makes sense given the lack of either profits or revenue growth. Of course, sentiment could become too negative, and the company may actually be making progress to profitability.

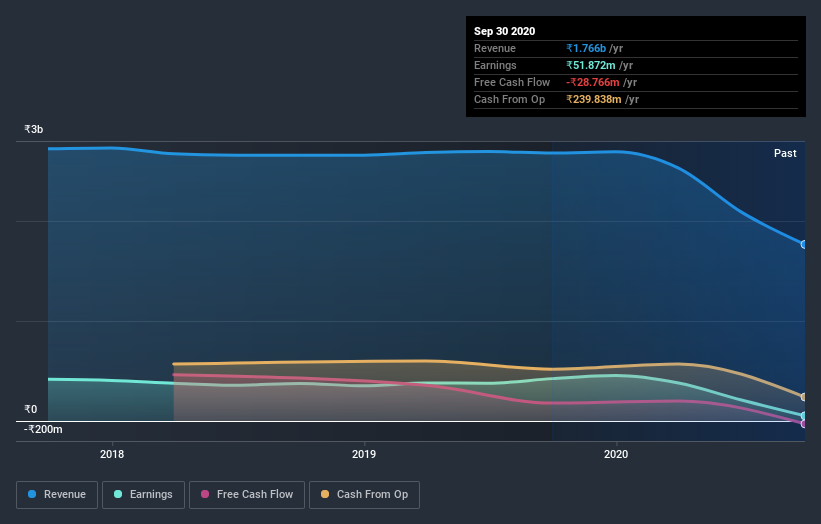

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of EIH Associated Hotels' earnings, revenue and cash flow.

A Different Perspective

EIH Associated Hotels shareholders are down 14% for the year, but the market itself is up 11%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 4% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand EIH Associated Hotels better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with EIH Associated Hotels (at least 1 which can't be ignored) , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

When trading EIH Associated Hotels or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if EIH Associated Hotels might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:EIHAHOTELS

EIH Associated Hotels

Owns, operates, and manages luxury hotels in India.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives