- India

- /

- Hospitality

- /

- NSEI:EIHAHOTELS

A Piece Of The Puzzle Missing From EIH Associated Hotels Limited's (NSE:EIHAHOTELS) 26% Share Price Climb

EIH Associated Hotels Limited (NSE:EIHAHOTELS) shareholders have had their patience rewarded with a 26% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 45% in the last year.

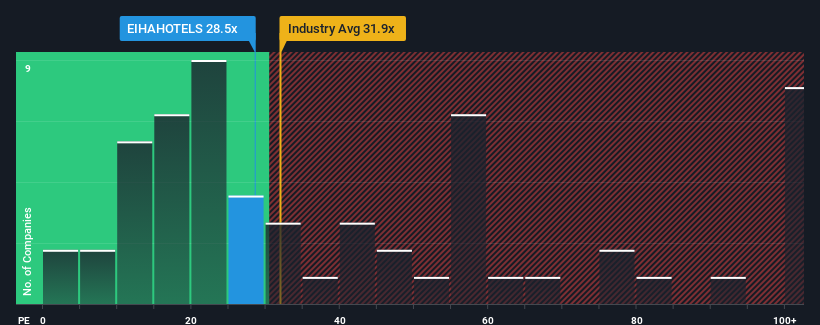

Although its price has surged higher, you could still be forgiven for feeling indifferent about EIH Associated Hotels' P/E ratio of 28.5x, since the median price-to-earnings (or "P/E") ratio in India is also close to 31x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been quite advantageous for EIH Associated Hotels as its earnings have been rising very briskly. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for EIH Associated Hotels

What Are Growth Metrics Telling Us About The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like EIH Associated Hotels' to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 102%. The latest three year period has also seen an excellent 1,108% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Comparing that to the market, which is only predicted to deliver 25% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we find it interesting that EIH Associated Hotels is trading at a fairly similar P/E to the market. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On EIH Associated Hotels' P/E

Its shares have lifted substantially and now EIH Associated Hotels' P/E is also back up to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that EIH Associated Hotels currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

You always need to take note of risks, for example - EIH Associated Hotels has 1 warning sign we think you should be aware of.

If these risks are making you reconsider your opinion on EIH Associated Hotels, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if EIH Associated Hotels might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:EIHAHOTELS

EIH Associated Hotels

Owns, operates, and manages luxury hotels in India.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives