Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Devyani International Limited (NSE:DEVYANI) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Devyani International

How Much Debt Does Devyani International Carry?

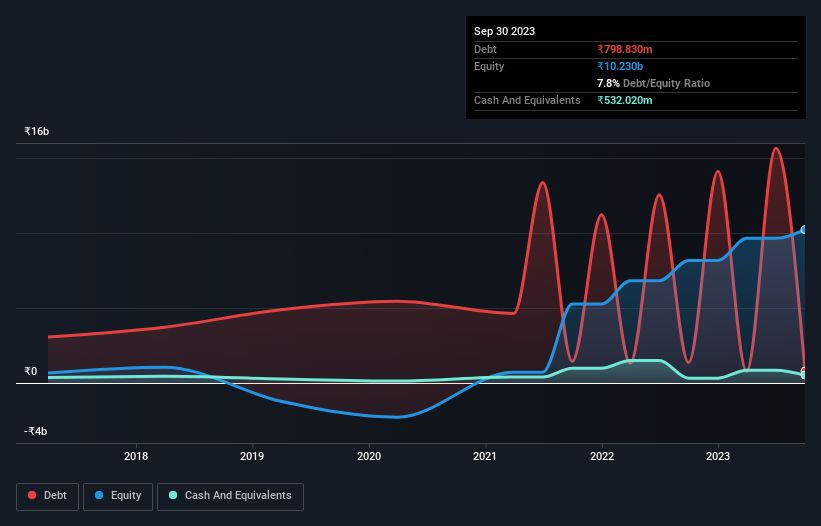

The image below, which you can click on for greater detail, shows that Devyani International had debt of ₹798.8m at the end of September 2023, a reduction from ₹1.37b over a year. However, it also had ₹532.0m in cash, and so its net debt is ₹266.8m.

A Look At Devyani International's Liabilities

We can see from the most recent balance sheet that Devyani International had liabilities of ₹5.88b falling due within a year, and liabilities of ₹15.2b due beyond that. Offsetting this, it had ₹532.0m in cash and ₹379.4m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₹20.2b.

Since publicly traded Devyani International shares are worth a total of ₹212.2b, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. Carrying virtually no net debt, Devyani International has a very light debt load indeed.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Devyani International's debt of just 0.052 times EBITDA is clearly modest. But EBIT was only 2.3 times the interest expense last year, which shows that the debt has negatively impacted the business, by constraining its options (and restricting its free cash flow). Sadly, Devyani International's EBIT actually dropped 9.5% in the last year. If that earnings trend continues then its debt load will grow heavy like the heart of a polar bear watching its sole cub. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Devyani International's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, Devyani International produced sturdy free cash flow equating to 57% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

When it comes to the balance sheet, the standout positive for Devyani International was the fact that it seems able handle its debt, based on its EBITDA, confidently. However, our other observations weren't so heartening. To be specific, it seems about as good at covering its interest expense with its EBIT as wet socks are at keeping your feet warm. When we consider all the factors mentioned above, we do feel a bit cautious about Devyani International's use of debt. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 2 warning signs for Devyani International that you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DEVYANI

Devyani International

Develops, manages, and operates quick service restaurants and food courts in India, Nepal, Nigeria, Thailand, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026