- India

- /

- Hospitality

- /

- NSEI:DEVYANI

Devyani International Limited's (NSE:DEVYANI) Share Price Could Signal Some Risk

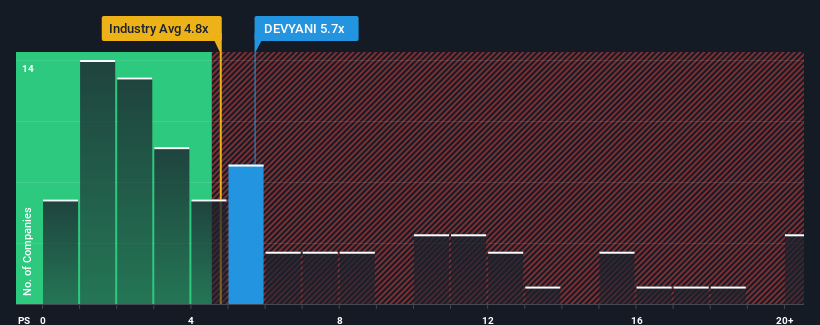

There wouldn't be many who think Devyani International Limited's (NSE:DEVYANI) price-to-sales (or "P/S") ratio of 5.7x is worth a mention when the median P/S for the Hospitality industry in India is similar at about 4.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Devyani International

How Devyani International Has Been Performing

With revenue growth that's inferior to most other companies of late, Devyani International has been relatively sluggish. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Devyani International will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Devyani International?

In order to justify its P/S ratio, Devyani International would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 15% last year. The latest three year period has also seen an excellent 188% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 21% per year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 30% each year, which is noticeably more attractive.

With this information, we find it interesting that Devyani International is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What We Can Learn From Devyani International's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at the analysts forecasts of Devyani International's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Devyani International (1 can't be ignored!) that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DEVYANI

Devyani International

Develops, manages, and operates quick service restaurants and food courts in India, Nepal, Nigeria, Thailand, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026