- India

- /

- Consumer Services

- /

- NSEI:COMPUSOFT

Compucom Software (NSE:COMPUSOFT) Has Affirmed Its Dividend Of ₹0.30

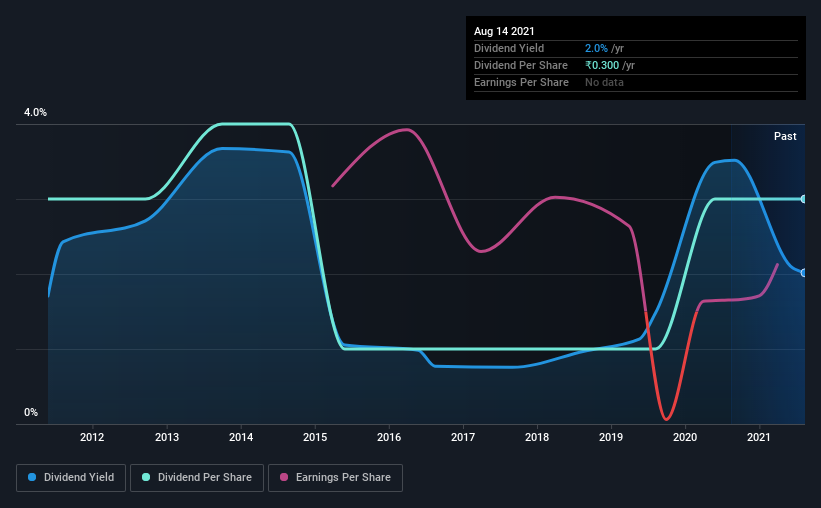

Compucom Software Limited (NSE:COMPUSOFT) has announced that it will pay a dividend of ₹0.30 per share on the 15th of October. This makes the dividend yield 2.0%, which will augment investor returns quite nicely.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Compucom Software's stock price has increased by 58% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

See our latest analysis for Compucom Software

Compucom Software Is Paying Out More Than It Is Earning

If the payments aren't sustainable, a high yield for a few years won't matter that much. Based on the last payment, Compucom Software's profits didn't cover the dividend, but the company was generating enough cash instead. Generally, we think cash is more important than accounting measures of profit, so with the cash flows easily covering the dividend, we don't think there is much reason to worry.

If the company can't turn things around, EPS could fall by 23.8% over the next year. If the dividend continues along the path it has been on recently, the payout ratio in 12 months could be 193%, which is definitely a bit high to be sustainable going forward.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. There hasn't been much of a change in the dividend over the last 10. Modest growth in the dividend is good to see, but we think this is offset by historical cuts to the payments. It is hard to live on a dividend income if the company's earnings are not consistent.

Dividend Growth Potential Is Shaky

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Over the past five years, it looks as though Compucom Software's EPS has declined at around 24% a year. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough.

Compucom Software's Dividend Doesn't Look Sustainable

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Compucom Software's payments, as there could be some issues with sustaining them into the future. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We don't think Compucom Software is a great stock to add to your portfolio if income is your focus.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've identified 5 warning signs for Compucom Software (1 makes us a bit uncomfortable!) that you should be aware of before investing. We have also put together a list of global stocks with a solid dividend.

If you’re looking to trade Compucom Software, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:COMPUSOFT

Compucom Software

Together with its subsidiary, CSL Infomedia Private Limited, operates as a software and education company in India and the United States.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Norwegian Air Shuttle's revenue will grow by 73.56% and profitability will soar

Alphabet - A Fundamental and Historical Valuation

The Compound Effect: From Acquisition to Integration

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Sleeping Giant" Stumbles, Then Wakes Up

Trending Discussion