- India

- /

- Consumer Services

- /

- NSEI:CPCAP

Here's Why We Think Career Point (NSE:CAREERP) Is Well Worth Watching

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Career Point (NSE:CAREERP). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Career Point

How Fast Is Career Point Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. It's no surprise, then, that I like to invest in companies with EPS growth. Career Point managed to grow EPS by 10% per year, over three years. That growth rate is fairly good, assuming the company can keep it up.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Unfortunately, Career Point's revenue dropped 22% last year, but the silver lining is that EBIT margins improved from 37% to 46%. That's not ideal.

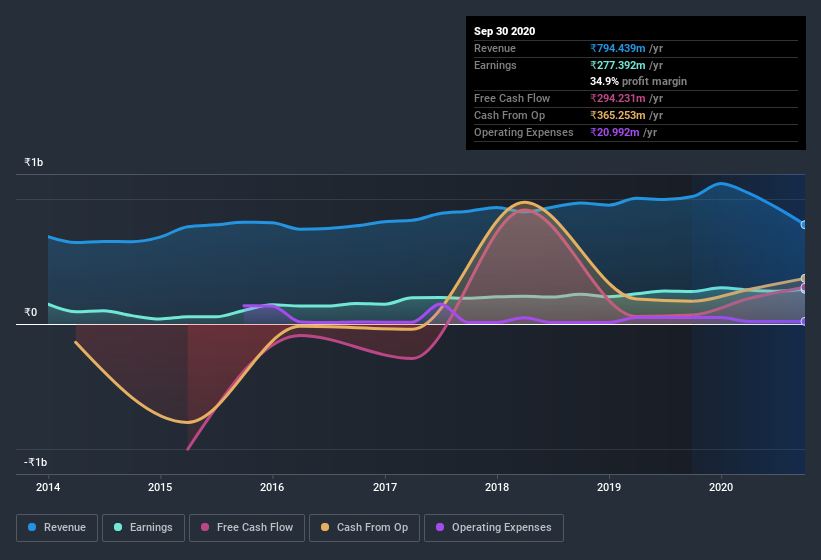

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since Career Point is no giant, with a market capitalization of ₹3.1b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Career Point Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

In twelve months, insiders sold -₹2.7m worth of Career Point shares. On the other hand, Founder Pramod Maheshwari paid ₹4.1m for shares, at a price of about ₹111 per share. So, on balance, that's positive.

On top of the insider buying, we can also see that Career Point insiders own a large chunk of the company. Indeed, with a collective holding of 73%, company insiders are in control and have plenty of capital behind the venture. This makes me think they will be incentivised to plan for the long term - something I like to see. In terms of absolute value, insiders have ₹2.3b invested in the business, using the current share price. That's nothing to sneeze at!

Does Career Point Deserve A Spot On Your Watchlist?

One positive for Career Point is that it is growing EPS. That's nice to see. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for my watchlist - and arguably a research priority. You should always think about risks though. Case in point, we've spotted 3 warning signs for Career Point you should be aware of.

The good news is that Career Point is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Career Point or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade CP Capital, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:CPCAP

CP Capital

An education company, engages in the provision of education consultancy, management, tutorial, and residential hostel services in India.

Solid track record with excellent balance sheet.