- India

- /

- Hospitality

- /

- NSEI:BARBEQUE

We Think Barbeque-Nation Hospitality (NSE:BARBEQUE) Is Taking Some Risk With Its Debt

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Barbeque-Nation Hospitality Limited (NSE:BARBEQUE) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Barbeque-Nation Hospitality

How Much Debt Does Barbeque-Nation Hospitality Carry?

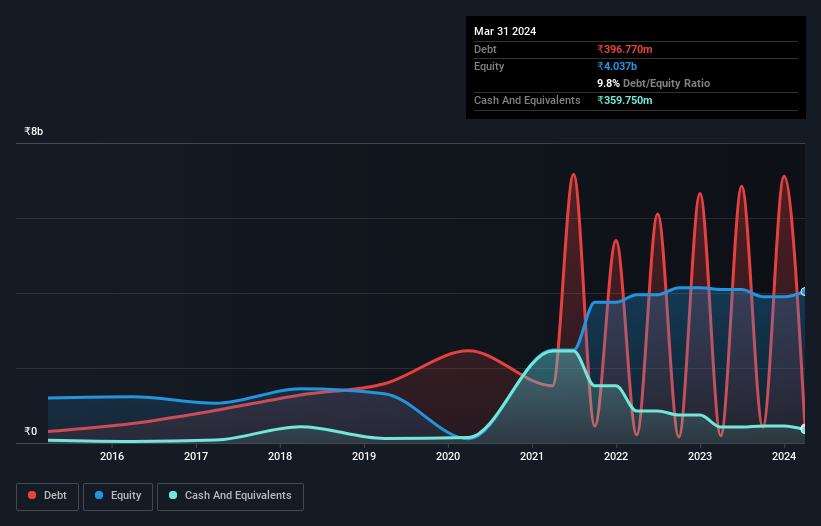

The image below, which you can click on for greater detail, shows that at March 2024 Barbeque-Nation Hospitality had debt of ₹396.8m, up from ₹195.6m in one year. However, it does have ₹359.8m in cash offsetting this, leading to net debt of about ₹37.0m.

How Strong Is Barbeque-Nation Hospitality's Balance Sheet?

The latest balance sheet data shows that Barbeque-Nation Hospitality had liabilities of ₹2.57b due within a year, and liabilities of ₹6.16b falling due after that. On the other hand, it had cash of ₹359.8m and ₹348.6m worth of receivables due within a year. So its liabilities total ₹8.03b more than the combination of its cash and short-term receivables.

Barbeque-Nation Hospitality has a market capitalization of ₹21.7b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt. Carrying virtually no net debt, Barbeque-Nation Hospitality has a very light debt load indeed.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Barbeque-Nation Hospitality has a net debt to EBITDA ratio of 0.017, suggesting a very conservative balance sheet. But EBIT was only 0.58 times the interest expense last year, which shows that the debt has negatively impacted the business, by constraining its options (and restricting its free cash flow). Shareholders should be aware that Barbeque-Nation Hospitality's EBIT was down 49% last year. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Barbeque-Nation Hospitality's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Barbeque-Nation Hospitality actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

We feel some trepidation about Barbeque-Nation Hospitality's difficulty EBIT growth rate, but we've got positives to focus on, too. For example, its conversion of EBIT to free cash flow and net debt to EBITDA give us some confidence in its ability to manage its debt. Looking at all the angles mentioned above, it does seem to us that Barbeque-Nation Hospitality is a somewhat risky investment as a result of its debt. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. Even though Barbeque-Nation Hospitality lost money on the bottom line, its positive EBIT suggests the business itself has potential. So you might want to check out how earnings have been trending over the last few years.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Barbeque-Nation Hospitality might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BARBEQUE

Barbeque-Nation Hospitality

Owns and operates a chain of casual dining restaurants under the Barbeque-Nation brand name in India, the United Arab Emirates, Oman, Malaysia, and Bahrain.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives