- India

- /

- Food and Staples Retail

- /

- NSEI:OSIAHYPER

We're Not Counting On Osia Hyper Retail (NSE:OSIAHYPER) To Sustain Its Statutory Profitability

It might be old fashioned, but we really like to invest in companies that make a profit, each and every year. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. This article will consider whether Osia Hyper Retail's (NSE:OSIAHYPER) statutory profits are a good guide to its underlying earnings.

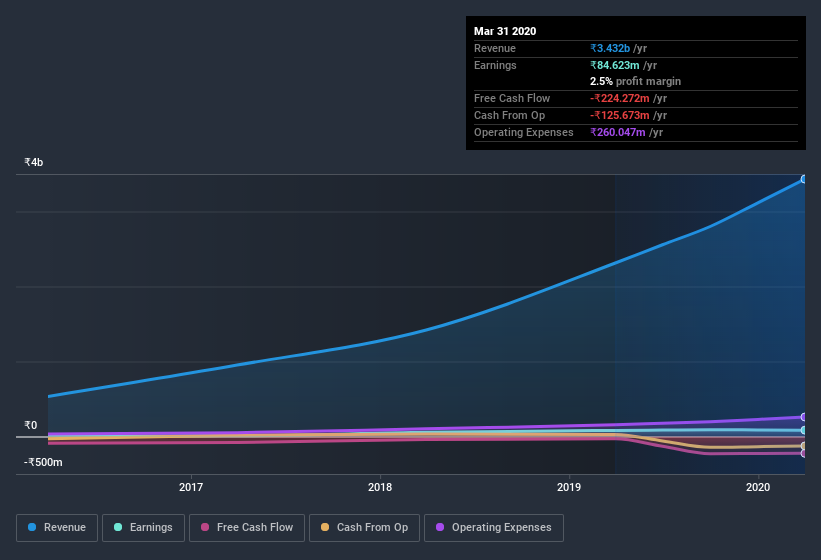

While Osia Hyper Retail was able to generate revenue of ₹3.43b in the last twelve months, we think its profit result of ₹84.6m was more important. Happily, it has grown both its profit and revenue over the last three years, as you can see in the chart below.

View our latest analysis for Osia Hyper Retail

Of course, when it comes to statutory profit, the devil is often in the detail, and we can get a better sense for a company by diving deeper into the financial statements. As a result, we think it's well worth considering what Osia Hyper Retail's cashflow (when compared to its earnings) can tell us about the nature of its statutory profit. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Osia Hyper Retail.

Zooming In On Osia Hyper Retail's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

Over the twelve months to March 2020, Osia Hyper Retail recorded an accrual ratio of 0.35. Unfortunately, that means its free cash flow was a lot less than its statutory profit, which makes us doubt the utility of profit as a guide. In the last twelve months it actually had negative free cash flow, with an outflow of ₹224m despite its profit of ₹84.6m, mentioned above. Coming off the back of negative free cash flow last year, we imagine some shareholders might wonder if its cash burn of ₹224m, this year, indicates high risk.

Our Take On Osia Hyper Retail's Profit Performance

As we have made quite clear, we're a bit worried that Osia Hyper Retail didn't back up the last year's profit with free cashflow. For this reason, we think that Osia Hyper Retail's statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. But the good news is that its EPS growth over the last three years has been very impressive. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. If you want to do dive deeper into Osia Hyper Retail, you'd also look into what risks it is currently facing. For example, we've found that Osia Hyper Retail has 3 warning signs (2 are significant!) that deserve your attention before going any further with your analysis.

This note has only looked at a single factor that sheds light on the nature of Osia Hyper Retail's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

When trading Osia Hyper Retail or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:OSIAHYPER

Osia Hyper Retail

Operates a supermarket chain under the Osia Hypermart name in India.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026