- India

- /

- Food and Staples Retail

- /

- NSEI:OSIAHYPER

Osia Hyper Retail (NSE:OSIAHYPER) Seems To Use Debt Quite Sensibly

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Osia Hyper Retail Limited (NSE:OSIAHYPER) makes use of debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Osia Hyper Retail

What Is Osia Hyper Retail's Debt?

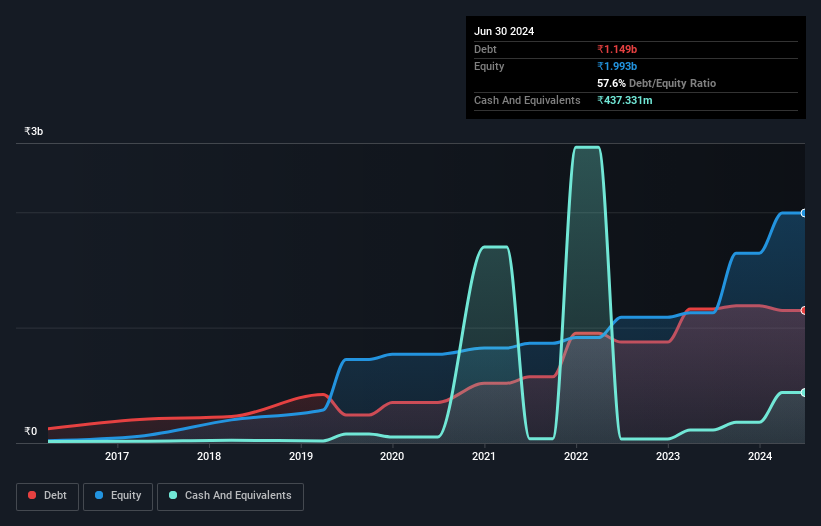

As you can see below, Osia Hyper Retail had ₹1.15b of debt, at March 2024, which is about the same as the year before. You can click the chart for greater detail. However, it also had ₹437.3m in cash, and so its net debt is ₹711.8m.

A Look At Osia Hyper Retail's Liabilities

Zooming in on the latest balance sheet data, we can see that Osia Hyper Retail had liabilities of ₹2.16b due within 12 months and liabilities of ₹1.32b due beyond that. Offsetting this, it had ₹437.3m in cash and ₹1.22b in receivables that were due within 12 months. So its liabilities total ₹1.83b more than the combination of its cash and short-term receivables.

Given Osia Hyper Retail has a market capitalization of ₹14.7b, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Osia Hyper Retail has a very low debt to EBITDA ratio of 0.88 so it is strange to see weak interest coverage, with last year's EBIT being only 1.9 times the interest expense. So while we're not necessarily alarmed we think that its debt is far from trivial. It is well worth noting that Osia Hyper Retail's EBIT shot up like bamboo after rain, gaining 79% in the last twelve months. That'll make it easier to manage its debt. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Osia Hyper Retail will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Osia Hyper Retail burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Osia Hyper Retail's conversion of EBIT to free cash flow was a real negative on this analysis, as was its interest cover. But its EBIT growth rate was significantly redeeming. When we consider all the factors mentioned above, we do feel a bit cautious about Osia Hyper Retail's use of debt. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. We'd be motivated to research the stock further if we found out that Osia Hyper Retail insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:OSIAHYPER

Osia Hyper Retail

Operates a supermarket chain under the Osia Hypermart name in India.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026