- India

- /

- Food and Staples Retail

- /

- NSEI:DMART

Here's Why We Think Avenue Supermarts (NSE:DMART) Is Well Worth Watching

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Avenue Supermarts (NSE:DMART). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

How Fast Is Avenue Supermarts Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. It certainly is nice to see that Avenue Supermarts has managed to grow EPS by 22% per year over three years. So it's not surprising to see the company trades on a very high multiple of (past) earnings.

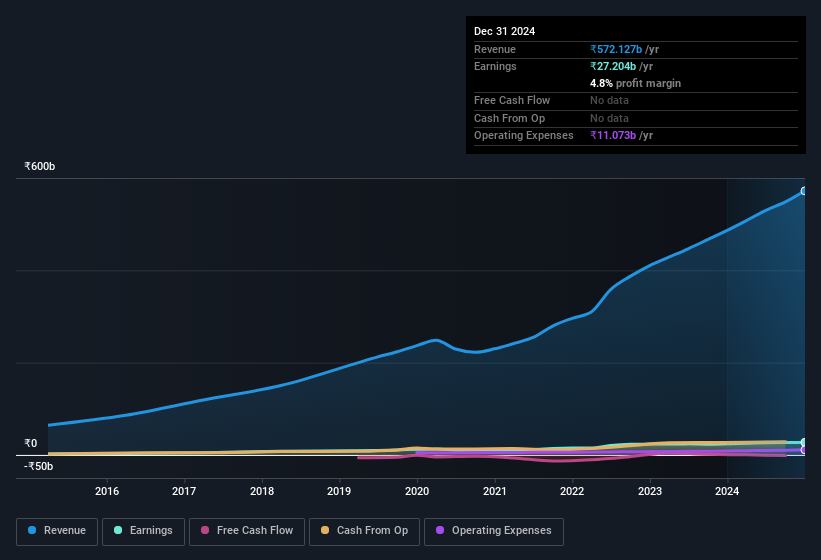

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While we note Avenue Supermarts achieved similar EBIT margins to last year, revenue grew by a solid 18% to ₹572b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Check out our latest analysis for Avenue Supermarts

Fortunately, we've got access to analyst forecasts of Avenue Supermarts' future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Avenue Supermarts Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that Avenue Supermarts insiders own a significant number of shares certainly is appealing. To be exact, company insiders hold 64% of the company, so their decisions have a significant impact on their investments. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. This insider holding amounts to This is an incredible endorsement from them.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Well, based on the CEO pay, you'd argue that they are indeed. The median total compensation for CEOs of companies similar in size to Avenue Supermarts, with market caps over ₹683b, is around ₹100m.

The CEO of Avenue Supermarts only received ₹50m in total compensation for the year ending March 2024. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Avenue Supermarts Deserve A Spot On Your Watchlist?

You can't deny that Avenue Supermarts has grown its earnings per share at a very impressive rate. That's attractive. If that's not enough, consider also that the CEO pay is quite reasonable, and insiders are well-invested alongside other shareholders. Everyone has their own preferences when it comes to investing but it definitely makes Avenue Supermarts look rather interesting indeed. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Avenue Supermarts that you should be aware of.

Although Avenue Supermarts certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Indian companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DMART

Avenue Supermarts

Engages in the business of organized retail and operating supermarkets under the D-Mart brand name in India.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives