TCNS Clothing Co. Limited (NSE:TCNSBRANDS) Stocks Shoot Up 31% But Its P/S Still Looks Reasonable

TCNS Clothing Co. Limited (NSE:TCNSBRANDS) shareholders would be excited to see that the share price has had a great month, posting a 31% gain and recovering from prior weakness. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 3.4% over the last year.

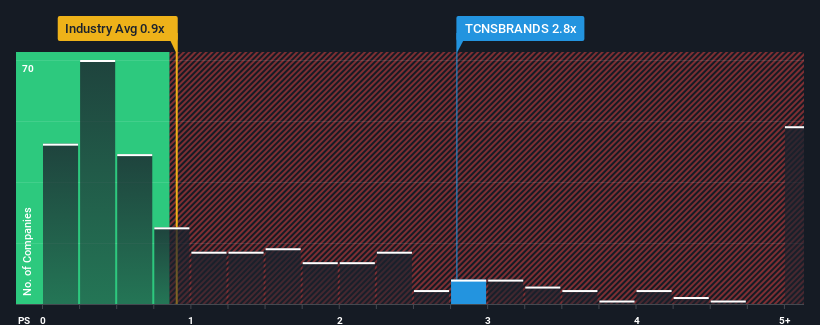

Following the firm bounce in price, you could be forgiven for thinking TCNS Clothing is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.8x, considering almost half the companies in India's Luxury industry have P/S ratios below 0.9x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for TCNS Clothing

How Has TCNS Clothing Performed Recently?

While the industry has experienced revenue growth lately, TCNS Clothing's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on TCNS Clothing will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like TCNS Clothing's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 13%. Even so, admirably revenue has lifted 60% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 18% during the coming year according to the sole analyst following the company. That's shaping up to be materially higher than the 12% growth forecast for the broader industry.

In light of this, it's understandable that TCNS Clothing's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

TCNS Clothing's P/S is on the rise since its shares have risen strongly. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into TCNS Clothing shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with TCNS Clothing (at least 2 which are a bit unpleasant), and understanding them should be part of your investment process.

If you're unsure about the strength of TCNS Clothing's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if TCNS Clothing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TCNSBRANDS

TCNS Clothing

Designs, manufactures, markets, and retails women's apparel and accessories in India and internationally.

Adequate balance sheet minimal.

Similar Companies

Market Insights

Community Narratives