Despite shrinking by ₹1.3b in the past week, Sutlej Textiles and Industries (NSE:SUTLEJTEX) shareholders are still up 70% over 5 years

Sutlej Textiles and Industries Limited (NSE:SUTLEJTEX) shareholders might be concerned after seeing the share price drop 22% in the last month. On the bright side the share price is up over the last half decade. Unfortunately its return of 60% is below the market return of 156%. Unfortunately not all shareholders will have held it for five years, so spare a thought for those caught in the 46% decline over the last three years: that's a long time to wait for profits.

While this past week has detracted from the company's five-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

Check out our latest analysis for Sutlej Textiles and Industries

Because Sutlej Textiles and Industries made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years Sutlej Textiles and Industries saw its revenue grow at 6.3% per year. That's a fairly respectable growth rate. The annual gain of 10% over five years is better than nothing, but falls short of the market. Arguably, that means, the market (previously) expected stronger growth from the company.

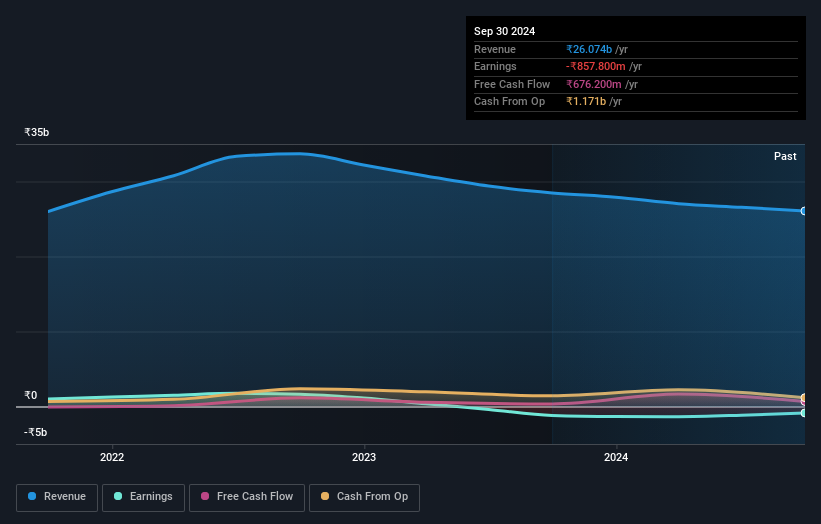

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Sutlej Textiles and Industries' balance sheet strength is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Sutlej Textiles and Industries' total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Sutlej Textiles and Industries' TSR of 70% over the last 5 years is better than the share price return.

A Different Perspective

While the broader market gained around 11% in the last year, Sutlej Textiles and Industries shareholders lost 16%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 11%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for Sutlej Textiles and Industries (2 don't sit too well with us) that you should be aware of.

But note: Sutlej Textiles and Industries may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SUTLEJTEX

Sutlej Textiles and Industries

Designs, manufactures, and distributes textiles to wholesalers, manufacturers, and retailers for the home furnishing industry in India, Bangladesh, Turkey, the United States of America, Hong Kong, Singapore, and internationally.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)