Mukhtarul Amin became the CEO of Superhouse Limited (NSE:SUPERHOUSE) in 2006, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

See our latest analysis for Superhouse

Comparing Superhouse Limited's CEO Compensation With the industry

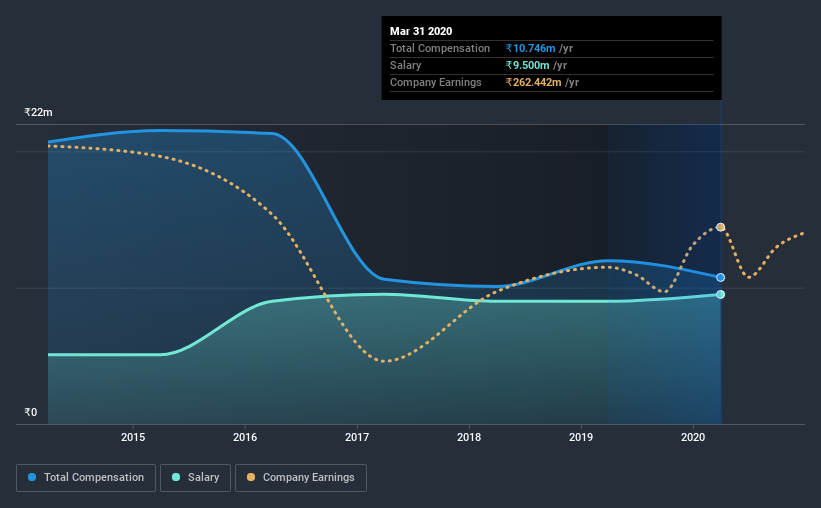

Our data indicates that Superhouse Limited has a market capitalization of ₹1.4b, and total annual CEO compensation was reported as ₹11m for the year to March 2020. That's a notable decrease of 10% on last year. Notably, the salary which is ₹9.50m, represents most of the total compensation being paid.

On comparing similar-sized companies in the industry with market capitalizations below ₹15b, we found that the median total CEO compensation was ₹3.6m. Hence, we can conclude that Mukhtarul Amin is remunerated higher than the industry median. Moreover, Mukhtarul Amin also holds ₹164m worth of Superhouse stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | ₹9.5m | ₹9.0m | 88% |

| Other | ₹1.2m | ₹3.0m | 12% |

| Total Compensation | ₹11m | ₹12m | 100% |

Talking in terms of the industry, salary represents all of total compensation among the companies we analyzed, while other remuneration is, interestingly, completely ignored. Superhouse sets aside a smaller share of compensation for salary, in comparison to the overall industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Superhouse Limited's Growth

Superhouse Limited has seen its earnings per share (EPS) increase by 13% a year over the past three years. It saw its revenue drop 25% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's always a tough situation when revenues are not growing, but ultimately profits are more important. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Superhouse Limited Been A Good Investment?

Given the total shareholder loss of 19% over three years, many shareholders in Superhouse Limited are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be lessto generous with CEO compensation.

In Summary...

As we noted earlier, Superhouse pays its CEO higher than the norm for similar-sized companies belonging to the same industry. However, we must not forget that the EPS growth has been very strong, but it's disappointing to see negative shareholder returns over the same period. Considering overall performance, we can't say Mukhtarul is underpaid, in fact compensation is definitely on the higher side.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We've identified 2 warning signs for Superhouse that investors should be aware of in a dynamic business environment.

Important note: Superhouse is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you decide to trade Superhouse, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:SUPERHOUSE

Superhouse

Engages in the manufacture and sale of leather and leather products, as well as textile garments in India and internationally.

Moderate risk with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026