Benign Growth For Sarla Performance Fibers Limited (NSE:SARLAPOLY) Underpins Stock's 26% Plummet

Sarla Performance Fibers Limited (NSE:SARLAPOLY) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 39%, which is great even in a bull market.

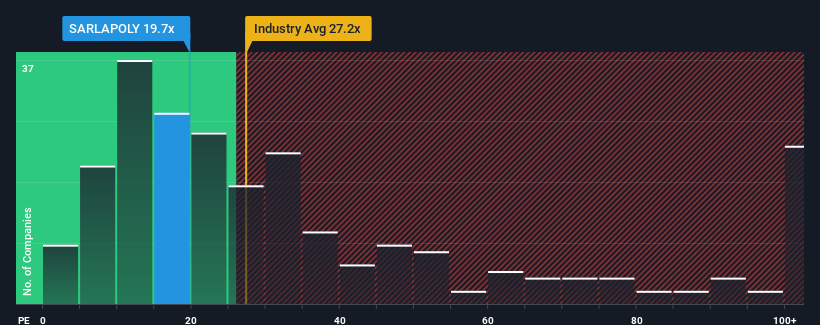

In spite of the heavy fall in price, Sarla Performance Fibers may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 19.7x, since almost half of all companies in India have P/E ratios greater than 29x and even P/E's higher than 54x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

As an illustration, earnings have deteriorated at Sarla Performance Fibers over the last year, which is not ideal at all. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

View our latest analysis for Sarla Performance Fibers

How Is Sarla Performance Fibers' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Sarla Performance Fibers' is when the company's growth is on track to lag the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 27%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 13% overall rise in EPS. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 24% shows it's noticeably less attractive on an annualised basis.

With this information, we can see why Sarla Performance Fibers is trading at a P/E lower than the market. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Sarla Performance Fibers' recently weak share price has pulled its P/E below most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Sarla Performance Fibers revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Sarla Performance Fibers, and understanding should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SARLAPOLY

Sarla Performance Fibers

Manufactures and sells yarns in India and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives