Here's Why It's Unlikely That Rupa & Company Limited's (NSE:RUPA) CEO Will See A Pay Rise This Year

Key Insights

- Rupa will host its Annual General Meeting on 1st of September

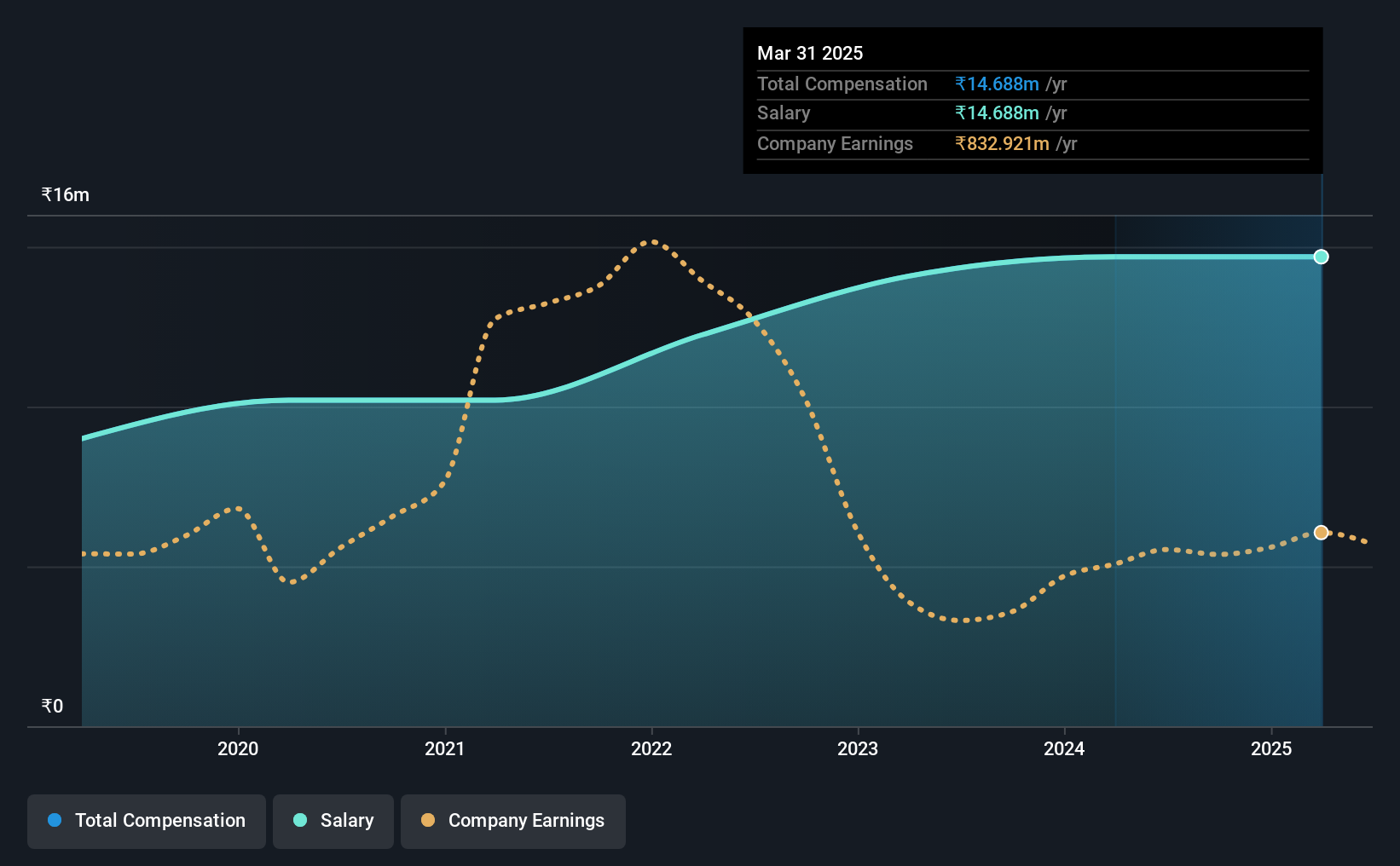

- CEO Kunj Agarwala's total compensation includes salary of ₹14.7m

- The total compensation is similar to the average for the industry

- Rupa's three-year loss to shareholders was 38% while its EPS was down 24% over the past three years

The results at Rupa & Company Limited (NSE:RUPA) have been quite disappointing recently and CEO Kunj Agarwala bears some responsibility for this. At the upcoming AGM on 1st of September, shareholders can hear from the board including their plans for turning around performance. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. The data we present below explains why we think CEO compensation is not consistent with recent performance.

See our latest analysis for Rupa

Comparing Rupa & Company Limited's CEO Compensation With The Industry

At the time of writing, our data shows that Rupa & Company Limited has a market capitalization of ₹16b, and reported total annual CEO compensation of ₹15m for the year to March 2025. There was no change in the compensation compared to last year. It is worth noting that the CEO compensation consists entirely of the salary, worth ₹15m.

On comparing similar companies from the Indian Luxury industry with market caps ranging from ₹8.7b to ₹35b, we found that the median CEO total compensation was ₹20m. From this we gather that Kunj Agarwala is paid around the median for CEOs in the industry. Furthermore, Kunj Agarwala directly owns ₹323m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | ₹15m | ₹15m | 100% |

| Other | - | - | - |

| Total Compensation | ₹15m | ₹15m | 100% |

On an industry level, around 98% of total compensation represents salary and 2% is other remuneration. Speaking on a company level, Rupa prefers to tread along a traditional path, disbursing all compensation through a salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Rupa & Company Limited's Growth

Rupa & Company Limited has reduced its earnings per share by 24% a year over the last three years. Its revenue is down 1.5% over the previous year.

Overall this is not a very positive result for shareholders. And the impression is worse when you consider revenue is down year-on-year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Rupa & Company Limited Been A Good Investment?

Few Rupa & Company Limited shareholders would feel satisfied with the return of -38% over three years. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Rupa pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

Shareholders may want to check for free if Rupa insiders are buying or selling shares.

Important note: Rupa is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RUPA

Rupa

Manufactures, markets, sells, and distributes hosiery products in knitted undergarments, casual wears, and thermal wears for men, women, and kids in India and internationally.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives