The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Premier Polyfilm Ltd. (NSE:PREMIERPOL) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Premier Polyfilm

What Is Premier Polyfilm's Debt?

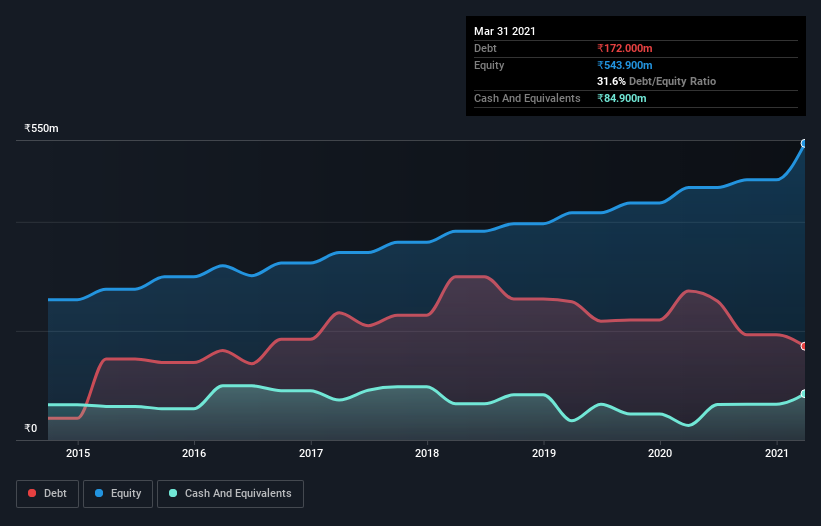

The image below, which you can click on for greater detail, shows that Premier Polyfilm had debt of ₹172.0m at the end of March 2021, a reduction from ₹273.2m over a year. However, it also had ₹84.9m in cash, and so its net debt is ₹87.1m.

How Strong Is Premier Polyfilm's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Premier Polyfilm had liabilities of ₹280.9m due within 12 months and liabilities of ₹80.0m due beyond that. Offsetting this, it had ₹84.9m in cash and ₹175.9m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₹100.1m.

Since publicly traded Premier Polyfilm shares are worth a total of ₹1.57b, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While Premier Polyfilm's low debt to EBITDA ratio of 0.56 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 5.4 times last year does give us pause. So we'd recommend keeping a close eye on the impact financing costs are having on the business. One way Premier Polyfilm could vanquish its debt would be if it stops borrowing more but continues to grow EBIT at around 11%, as it did over the last year. When analysing debt levels, the balance sheet is the obvious place to start. But it is Premier Polyfilm's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the most recent three years, Premier Polyfilm recorded free cash flow worth 72% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Happily, Premier Polyfilm's impressive conversion of EBIT to free cash flow implies it has the upper hand on its debt. And the good news does not stop there, as its net debt to EBITDA also supports that impression! Zooming out, Premier Polyfilm seems to use debt quite reasonably; and that gets the nod from us. While debt does bring risk, when used wisely it can also bring a higher return on equity. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 2 warning signs for Premier Polyfilm that you should be aware of before investing here.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you’re looking to trade Premier Polyfilm, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:PREMIERPOL

Premier Polyfilm

Engages in the manufacture and sale of vinyl flooring, sheeting, and artificial leather.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives