Three Indian Stocks Possibly Undervalued By Market Estimates In October 2024

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has experienced a 4.2% decline, yet it remains up by an impressive 40% over the past year, with earnings forecasted to grow by 18% annually. In such a fluctuating environment, identifying potentially undervalued stocks can be crucial for investors seeking opportunities that align with long-term growth prospects and current market dynamics.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Everest Kanto Cylinder (NSEI:EKC) | ₹179.67 | ₹311.00 | 42.2% |

| Sudarshan Chemical Industries (BSE:506655) | ₹976.35 | ₹1833.61 | 46.8% |

| Titagarh Rail Systems (NSEI:TITAGARH) | ₹1166.30 | ₹2150.59 | 45.8% |

| RITES (NSEI:RITES) | ₹290.65 | ₹518.13 | 43.9% |

| IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹388.45 | ₹762.32 | 49% |

| Vedanta (NSEI:VEDL) | ₹469.05 | ₹902.50 | 48% |

| Patel Engineering (BSE:531120) | ₹49.47 | ₹90.23 | 45.2% |

| IRB Infrastructure Developers (NSEI:IRB) | ₹52.56 | ₹89.57 | 41.3% |

| Tarsons Products (NSEI:TARSONS) | ₹400.60 | ₹707.26 | 43.4% |

| Strides Pharma Science (NSEI:STAR) | ₹1535.10 | ₹2704.30 | 43.2% |

Let's review some notable picks from our screened stocks.

Orchid Pharma (NSEI:ORCHPHARMA)

Overview: Orchid Pharma Limited is a pharmaceutical company involved in the development, manufacture, and marketing of active pharmaceutical ingredients, bulk actives, finished dosage formulations, and nutraceuticals in India with a market cap of ₹67.14 billion.

Operations: The company's revenue primarily comes from its pharmaceuticals segment, which generated ₹8.81 billion.

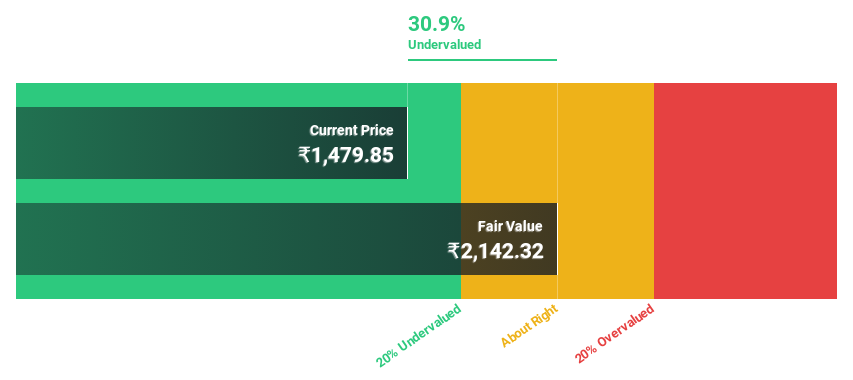

Estimated Discount To Fair Value: 38.2%

Orchid Pharma is trading at ₹1,323.80, significantly below its estimated fair value of ₹2,142.32, suggesting it may be undervalued based on cash flows. The company's earnings and revenue are forecast to grow substantially faster than the Indian market, with earnings expected to rise by 43.67% annually over the next three years. Despite a recent GST audit resulting in a tax liability order, Orchid's strong growth prospects and index inclusion highlight its potential value proposition.

- The growth report we've compiled suggests that Orchid Pharma's future prospects could be on the up.

- Get an in-depth perspective on Orchid Pharma's balance sheet by reading our health report here.

Pearl Global Industries (NSEI:PGIL)

Overview: Pearl Global Industries Limited, along with its subsidiaries, manufactures and exports readymade garments both in India and internationally, with a market cap of ₹42.06 billion.

Operations: Revenue Segments (in millions of ₹): The company generates revenue through the manufacturing and export of readymade garments.

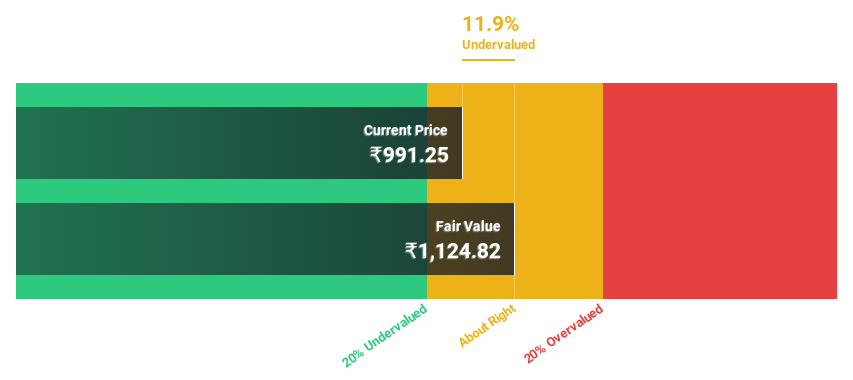

Estimated Discount To Fair Value: 18.3%

Pearl Global Industries is trading at ₹917.15, which is 18.3% below its estimated fair value of ₹1,122.55, indicating potential undervaluation based on cash flows. The company's earnings are forecast to grow significantly by 26.6% annually over the next three years, outpacing the Indian market's growth rate of 17.5%. Recent operational challenges in Bangladesh have been resolved, and inclusion in the S&P Global BMI Index underscores its strategic positioning and growth prospects.

- In light of our recent growth report, it seems possible that Pearl Global Industries' financial performance will exceed current levels.

- Navigate through the intricacies of Pearl Global Industries with our comprehensive financial health report here.

Titagarh Rail Systems (NSEI:TITAGARH)

Overview: Titagarh Rail Systems Limited manufactures and sells freight and passenger rail systems in India and internationally, with a market cap of ₹157.07 billion.

Operations: The company generates revenue from two main segments: Passenger Rail Systems, contributing ₹3.32 billion, and Freight Rail Systems (including shipbuilding, bridges, and defense), accounting for ₹35.14 billion.

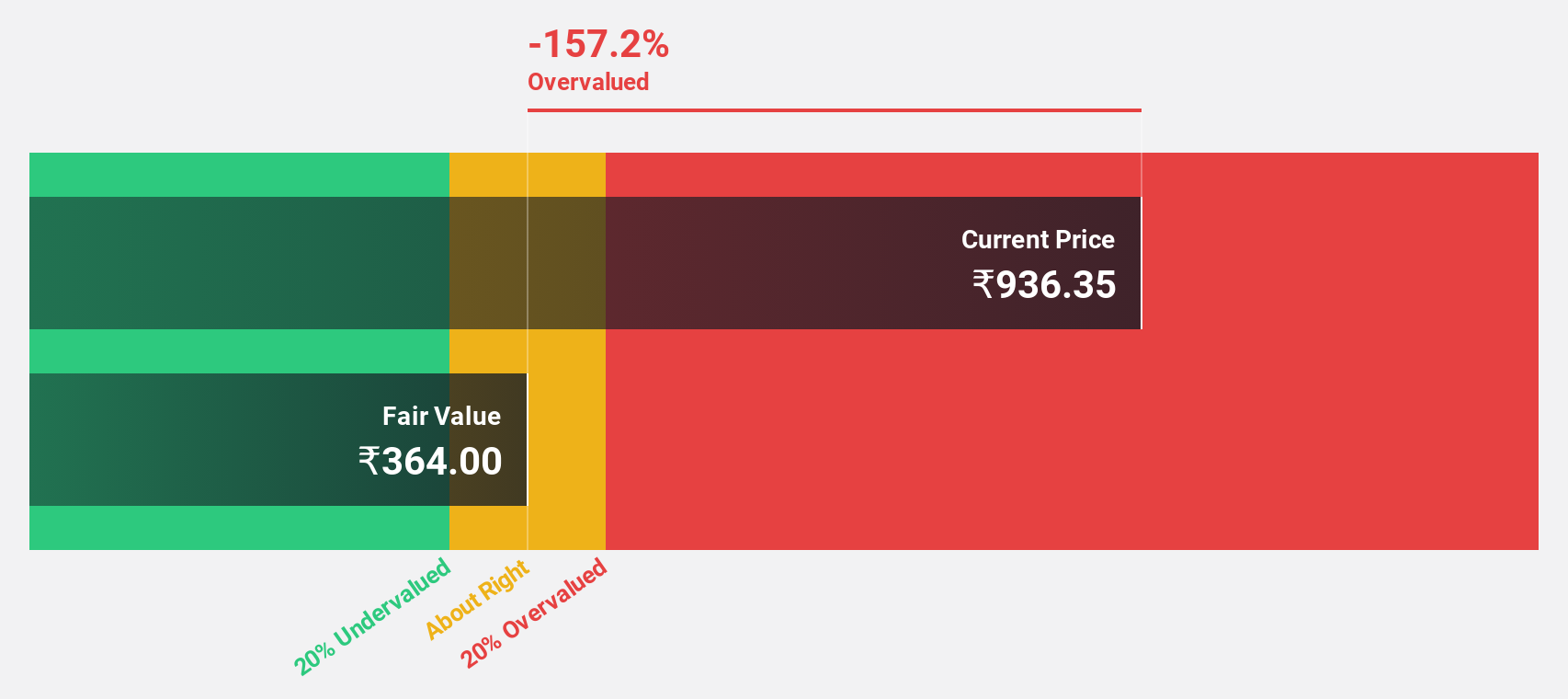

Estimated Discount To Fair Value: 45.8%

Titagarh Rail Systems, trading at ₹1,166.30 and significantly below its estimated fair value of ₹2,150.59, presents a potential undervaluation based on cash flows. Earnings are expected to grow robustly by 30.1% annually over the next three years, surpassing market growth rates. Recent developments include a revised wagon order with Indian Railways worth ₹71 billion, which aligns capacity with demand and mitigates potential penalties from undelivered orders.

- Upon reviewing our latest growth report, Titagarh Rail Systems' projected financial performance appears quite optimistic.

- Click here to discover the nuances of Titagarh Rail Systems with our detailed financial health report.

Make It Happen

- Unlock our comprehensive list of 28 Undervalued Indian Stocks Based On Cash Flows by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:PGIL

Pearl Global Industries

Manufactures and exports readymade garments in India and internationally.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives