If EPS Growth Is Important To You, Nandan Denim (NSE:NDL) Presents An Opportunity

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Nandan Denim (NSE:NDL). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Nandan Denim

How Fast Is Nandan Denim Growing?

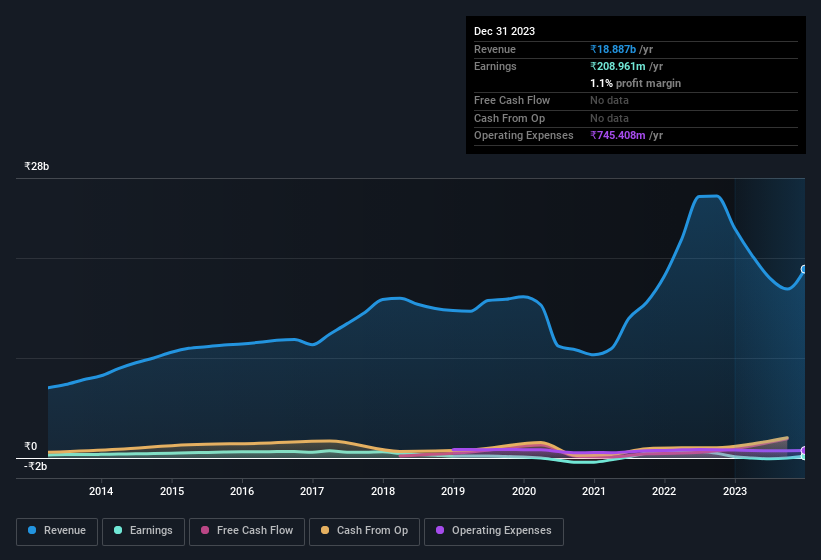

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years Nandan Denim grew its EPS by 7.7% per year. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Despite consistency in EBIT margins year on year, Nandan Denim has actually recorded a dip in revenue. While this may raise concerns, investors should investigate the reasoning behind this.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Nandan Denim isn't a huge company, given its market capitalisation of ₹4.7b. That makes it extra important to check on its balance sheet strength.

Are Nandan Denim Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. Nandan Denim followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. To be specific, they have ₹1.1b worth of shares. This considerable investment should help drive long-term value in the business. Those holdings account for over 24% of the company; visible skin in the game.

Is Nandan Denim Worth Keeping An Eye On?

As previously touched on, Nandan Denim is a growing business, which is encouraging. If that's not enough on its own, there is also the rather notable levels of insider ownership. That combination is very appealing. So yes, we do think the stock is worth keeping an eye on. We should say that we've discovered 2 warning signs for Nandan Denim (1 is a bit unpleasant!) that you should be aware of before investing here.

Although Nandan Denim certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Indian companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Nandan Denim might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NDL

Nandan Denim

Engages in the manufacture and sale of denim and cotton fabrics, dyed yarns, shirting fabrics, and fibers in India.

Good value with adequate balance sheet.