Lambodhara Textiles Limited's (NSE:LAMBODHARA) 26% Dip In Price Shows Sentiment Is Matching Earnings

Unfortunately for some shareholders, the Lambodhara Textiles Limited (NSE:LAMBODHARA) share price has dived 26% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 35% share price drop.

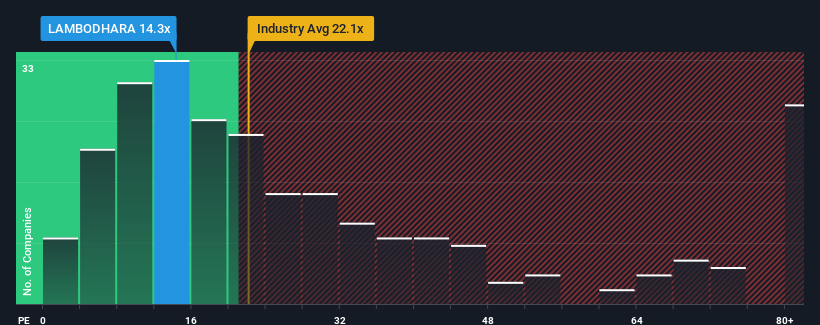

Although its price has dipped substantially, given about half the companies in India have price-to-earnings ratios (or "P/E's") above 25x, you may still consider Lambodhara Textiles as an attractive investment with its 14.3x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Lambodhara Textiles certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Lambodhara Textiles

How Is Lambodhara Textiles' Growth Trending?

In order to justify its P/E ratio, Lambodhara Textiles would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 127% last year. Still, incredibly EPS has fallen 57% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 25% shows it's an unpleasant look.

In light of this, it's understandable that Lambodhara Textiles' P/E would sit below the majority of other companies. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Key Takeaway

The softening of Lambodhara Textiles' shares means its P/E is now sitting at a pretty low level. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Lambodhara Textiles revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Lambodhara Textiles (at least 1 which shouldn't be ignored), and understanding these should be part of your investment process.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:LAMBODHARA

Flawless balance sheet with proven track record.

Market Insights

Community Narratives