Does Lagnam Spintex (NSE:LAGNAM) Deserve A Spot On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like Lagnam Spintex (NSE:LAGNAM), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Lagnam Spintex

Lagnam Spintex's Improving Profits

In business, though not in life, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. It is therefore awe-striking that Lagnam Spintex's EPS went from ₹2.56 to ₹16.30 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company. Could this be a sign that the business has reached an inflection point?

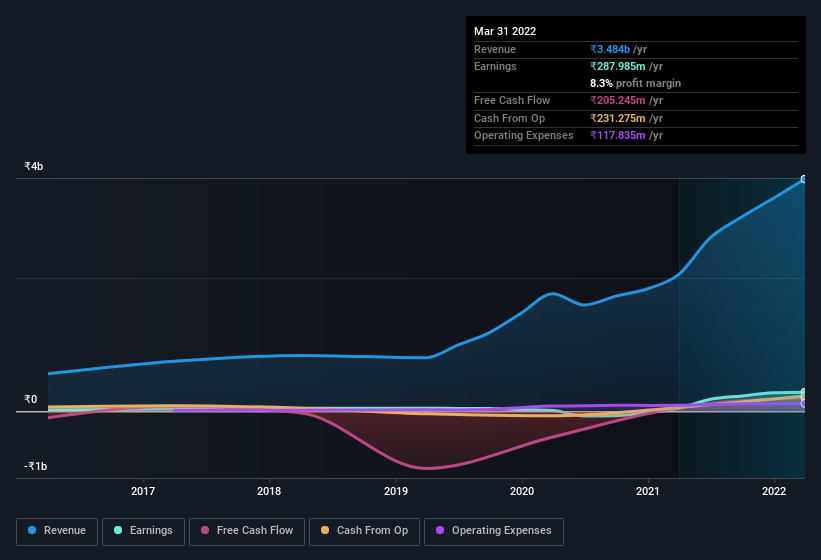

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Lagnam Spintex is growing revenues, and EBIT margins improved by 5.6 percentage points to 15%, over the last year. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since Lagnam Spintex is no giant, with a market capitalization of ₹1.2b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Lagnam Spintex Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Not only did Lagnam Spintex insiders refrain from selling stock during the year, but they also spent ₹5.7m buying it. That's nice to see, because it suggests insiders are optimistic. It is also worth noting that it was MD, Promoter & Executive Director Anand Mangal who made the biggest single purchase, worth ₹3.7m, paying ₹47.44 per share.

On top of the insider buying, we can also see that Lagnam Spintex insiders own a large chunk of the company. In fact, they own 39% of the shares, making insiders a very influential shareholder group. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. Valued at only ₹1.2b Lagnam Spintex is really small for a listed company. That means insiders only have ₹469m worth of shares, despite the large proportional holding. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Anand Mangal, is paid less than the median for similar sized companies. I discovered that the median total compensation for the CEOs of companies like Lagnam Spintex with market caps under ₹15b is about ₹3.0m.

The Lagnam Spintex CEO received total compensation of only ₹2.6m in the year to . This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Does Lagnam Spintex Deserve A Spot On Your Watchlist?

Lagnam Spintex's earnings per share have taken off like a rocket aimed right at the moon. Just as heartening; insiders both own and are buying more stock. Because of the potential that it has reached an inflection point, I'd suggest Lagnam Spintex belongs on the top of your watchlist. What about risks? Every company has them, and we've spotted 4 warning signs for Lagnam Spintex (of which 1 is a bit unpleasant!) you should know about.

The good news is that Lagnam Spintex is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:LAGNAM

Lagnam Spintex

Manufactures and sells cotton yarns in India and internationally.

Slightly overvalued with questionable track record.

Similar Companies

Market Insights

Community Narratives