Does K.P.R. Mill (NSE:KPRMILL) Deserve A Spot On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in K.P.R. Mill (NSE:KPRMILL). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for K.P.R. Mill

How Fast Is K.P.R. Mill Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Impressively, K.P.R. Mill has grown EPS by 35% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

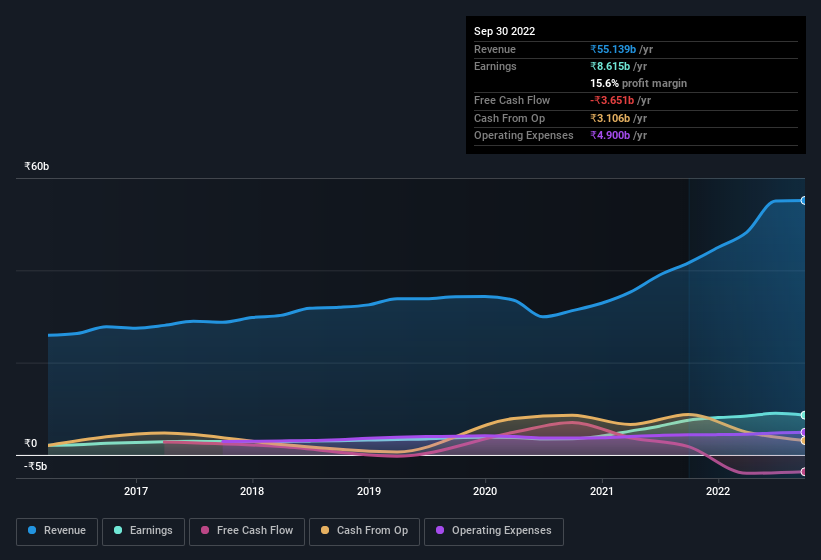

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. On the revenue front, K.P.R. Mill has done well over the past year, growing revenue by 32% to ₹55b but EBIT margin figures were less stellar, seeing a decline over the last 12 months. If EBIT margins are able to stay balanced and this revenue growth continues, then we should see brighter days ahead.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for K.P.R. Mill's future EPS 100% free.

Are K.P.R. Mill Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So those who are interested in K.P.R. Mill will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. Indeed, with a collective holding of 72%, company insiders are in control and have plenty of capital behind the venture. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. At the current share price, that insider holding is worth a staggering ₹127b. That level of investment from insiders is nothing to sneeze at.

Is K.P.R. Mill Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into K.P.R. Mill's strong EPS growth. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. On the balance of its merits, solid EPS growth and company insiders who are aligned with the shareholders would indicate a business that is worthy of further research. You still need to take note of risks, for example - K.P.R. Mill has 1 warning sign we think you should be aware of.

Although K.P.R. Mill certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if K.P.R. Mill might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KPRMILL

K.P.R. Mill

Operates as an integrated apparel manufacturing company in India and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives