We Ran A Stock Scan For Earnings Growth And Kalyan Jewellers India (NSE:KALYANKJIL) Passed With Ease

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Kalyan Jewellers India (NSE:KALYANKJIL). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Kalyan Jewellers India with the means to add long-term value to shareholders.

Check out our latest analysis for Kalyan Jewellers India

Kalyan Jewellers India's Improving Profits

In the last three years Kalyan Jewellers India's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. Kalyan Jewellers India boosted its trailing twelve month EPS from ₹4.23 to ₹5.14, in the last year. There's little doubt shareholders would be happy with that 22% gain.

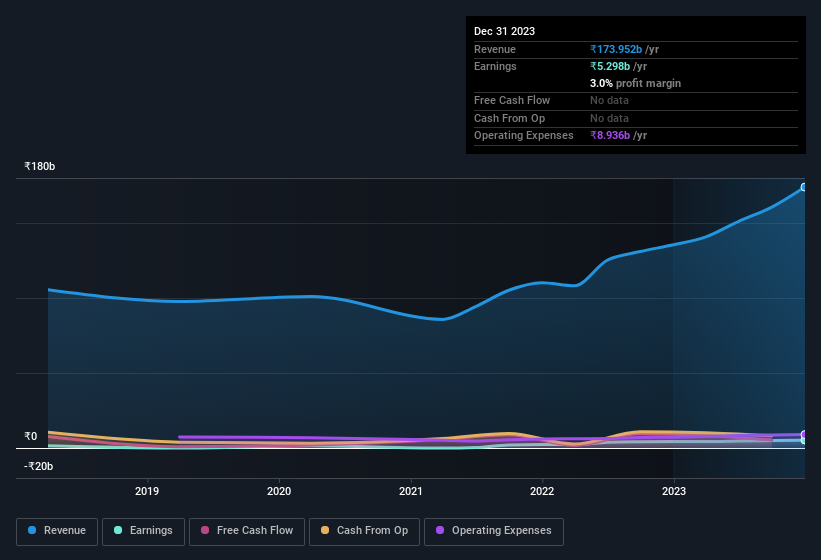

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Kalyan Jewellers India maintained stable EBIT margins over the last year, all while growing revenue 28% to ₹174b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Kalyan Jewellers India's future EPS 100% free.

Are Kalyan Jewellers India Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So we're pleased to report that Kalyan Jewellers India insiders own a meaningful share of the business. Indeed, with a collective holding of 61%, company insiders are in control and have plenty of capital behind the venture. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. This insider holding amounts to That means they have plenty of their own capital riding on the performance of the business!

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. A brief analysis of the CEO compensation suggests they are. Our analysis has discovered that the median total compensation for the CEOs of companies like Kalyan Jewellers India with market caps between ₹166b and ₹530b is about ₹44m.

Kalyan Jewellers India's CEO took home a total compensation package of ₹16m in the year prior to March 2023. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Should You Add Kalyan Jewellers India To Your Watchlist?

One important encouraging feature of Kalyan Jewellers India is that it is growing profits. The fact that EPS is growing is a genuine positive for Kalyan Jewellers India, but the pleasant picture gets better than that. With company insiders aligning themselves considerably with the company's success and modest CEO compensation, there's no arguments that this is a stock worth looking into. It is worth noting though that we have found 1 warning sign for Kalyan Jewellers India that you need to take into consideration.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in IN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Kalyan Jewellers India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KALYANKJIL

Kalyan Jewellers India

Manufactures and retails various gold and precious stone studded jewelry products.

Exceptional growth potential with excellent balance sheet.