Does Jindal Worldwide (NSE:JINDWORLD) Deserve A Spot On Your Watchlist?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Jindal Worldwide (NSE:JINDWORLD). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Jindal Worldwide

Jindal Worldwide's Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. I, for one, am blown away by the fact that Jindal Worldwide has grown EPS by 45% per year, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches my attention; like a crow with a sparkly stone.

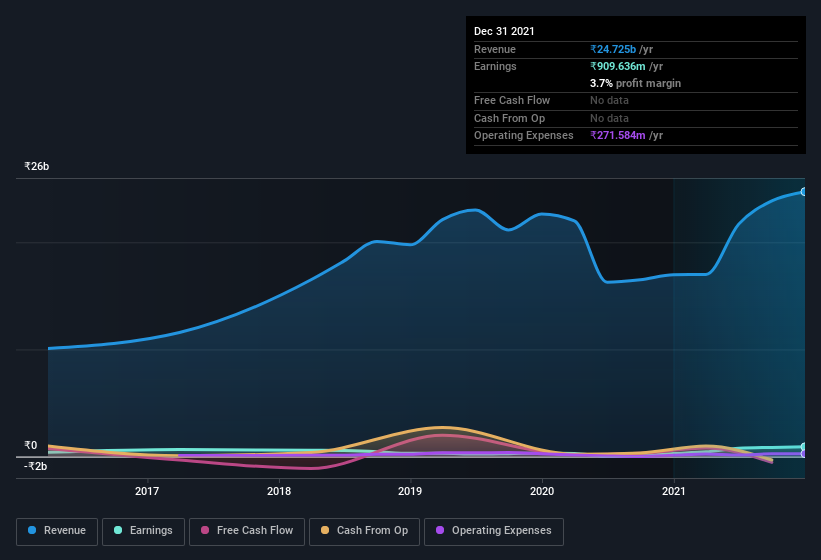

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Jindal Worldwide's EBIT margins were flat over the last year, revenue grew by a solid 46% to ₹25b. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Jindal Worldwide's balance sheet strength, before getting too excited.

Are Jindal Worldwide Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The first bit of good news is that no Jindal Worldwide insiders reported share sales in the last twelve months. Even better, though, is that the MD & Director, Amit Agrawal, bought a whopping ₹21m worth of shares, paying about ₹85.92 per share, on average. To me that means at least one insider thinks that the company is doing well - and they are backing that view with cash.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Jindal Worldwide insiders own more than a third of the company. In fact, they own 83% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. At the current share price, that insider holding is worth a whopping ₹46b. That means they have plenty of their own capital riding on the performance of the business!

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Amit Agrawal, is paid less than the median for similar sized companies. For companies with market capitalizations between ₹31b and ₹124b, like Jindal Worldwide, the median CEO pay is around ₹26m.

The Jindal Worldwide CEO received total compensation of only ₹2.4m in the year to . This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Jindal Worldwide To Your Watchlist?

Jindal Worldwide's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Jindal Worldwide deserves timely attention. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Jindal Worldwide (at least 1 which is a bit concerning) , and understanding them should be part of your investment process.

As a growth investor I do like to see insider buying. But Jindal Worldwide isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:JINDWORLD

Jindal Worldwide

Engages in the manufacture and sale of textile products in India and internationally.

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026