The Market Lifts Indo Rama Synthetics (India) Limited (NSE:INDORAMA) Shares 30% But It Can Do More

Indo Rama Synthetics (India) Limited (NSE:INDORAMA) shareholders have had their patience rewarded with a 30% share price jump in the last month. Taking a wider view, although not as strong as the last month, the full year gain of 19% is also fairly reasonable.

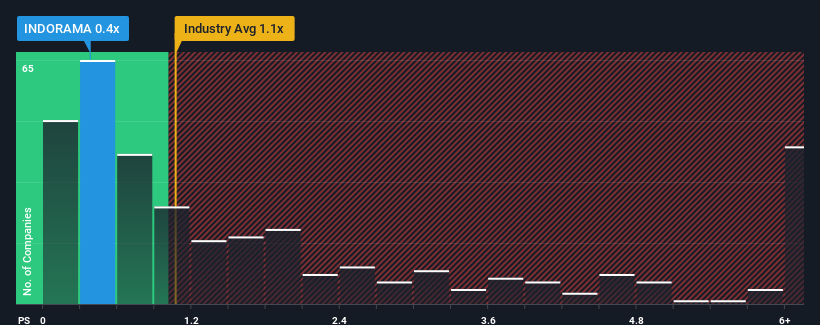

Although its price has surged higher, it would still be understandable if you think Indo Rama Synthetics (India) is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.4x, considering almost half the companies in India's Luxury industry have P/S ratios above 1.1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Indo Rama Synthetics (India)

What Does Indo Rama Synthetics (India)'s P/S Mean For Shareholders?

The revenue growth achieved at Indo Rama Synthetics (India) over the last year would be more than acceptable for most companies. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Indo Rama Synthetics (India) will help you shine a light on its historical performance.How Is Indo Rama Synthetics (India)'s Revenue Growth Trending?

Indo Rama Synthetics (India)'s P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a decent 10% gain to the company's revenues. The latest three year period has also seen an excellent 55% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 13% shows it's noticeably more attractive.

With this in mind, we find it intriguing that Indo Rama Synthetics (India)'s P/S isn't as high compared to that of its industry peers. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Final Word

Indo Rama Synthetics (India)'s stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Indo Rama Synthetics (India) revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

You always need to take note of risks, for example - Indo Rama Synthetics (India) has 1 warning sign we think you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Indo Rama Synthetics (India), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:INDORAMA

Indo Rama Synthetics (India)

Trades in and manufactures of polyester products in India, Turkey, Nepal, and internationally.

Slightly overvalued with worrying balance sheet.

Similar Companies

Market Insights

Community Narratives