Is Now The Time To Put Indo Count Industries (NSE:ICIL) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Indo Count Industries (NSE:ICIL). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Indo Count Industries

How Fast Is Indo Count Industries Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. Who among us would not applaud Indo Count Industries's stratospheric annual EPS growth of 56%, compound, over the last three years? While that sort of growth rate isn't sustainable for long, it certainly catches my attention; like a crow with a sparkly stone.

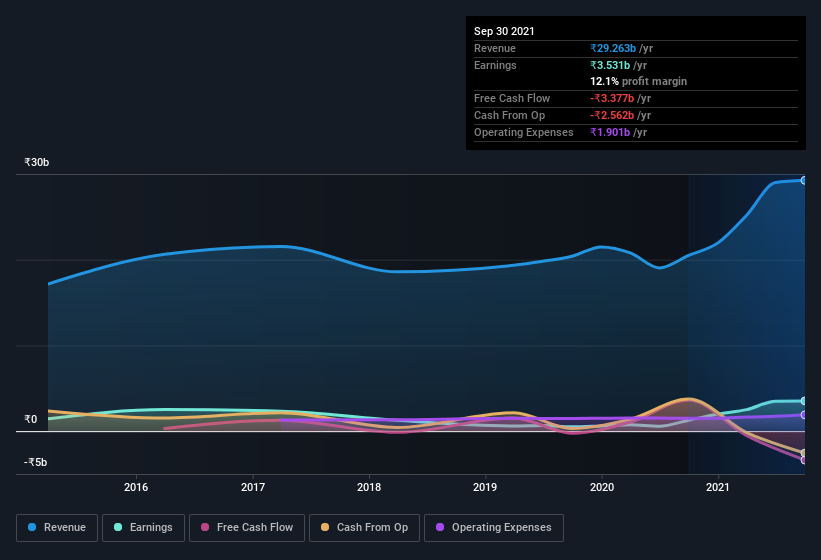

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Indo Count Industries shareholders can take confidence from the fact that EBIT margins are up from 8.2% to 15%, and revenue is growing. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Indo Count Industries Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. So it is good to see that Indo Count Industries insiders have a significant amount of capital invested in the stock. Given insiders own a small fortune of shares, currently valued at ₹5.6b, they have plenty of motivation to push the business to succeed. That holding amounts to 12% of the stock on issue, thus making insiders influential, and aligned, owners of the business.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. For companies with market capitalizations between ₹30b and ₹120b, like Indo Count Industries, the median CEO pay is around ₹30m.

The Indo Count Industries CEO received ₹20m in compensation for the year ending . That comes in below the average for similar sized companies, and seems pretty reasonable to me. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. I'd also argue reasonable pay levels attest to good decision making more generally.

Should You Add Indo Count Industries To Your Watchlist?

Indo Count Industries's earnings have taken off like any random crypto-currency did, back in 2017. The sweetener is that insiders have a mountain of stock, and the CEO remuneration is quite reasonable. The strong EPS improvement suggests the businesses is humming along. Big growth can make big winners, so I do think Indo Count Industries is worth considering carefully. We don't want to rain on the parade too much, but we did also find 4 warning signs for Indo Count Industries (2 are a bit unpleasant!) that you need to be mindful of.

Although Indo Count Industries certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:ICIL

Indo Count Industries

Manufactures and sells home textile products in India and internationally.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026