Garware Technical Fibres Limited Just Missed Earnings - But Analysts Have Updated Their Models

As you might know, Garware Technical Fibres Limited (NSE:GARFIBRES) last week released its latest first-quarter, and things did not turn out so great for shareholders. Results look to have been somewhat negative - revenue fell 3.5% short of analyst estimates at ₹3.4b, and statutory earnings of ₹23.38 per share missed forecasts by 8.7%. Following the result, the analyst has updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. So we gathered the latest post-earnings forecasts to see what estimate suggests is in store for next year.

View our latest analysis for Garware Technical Fibres

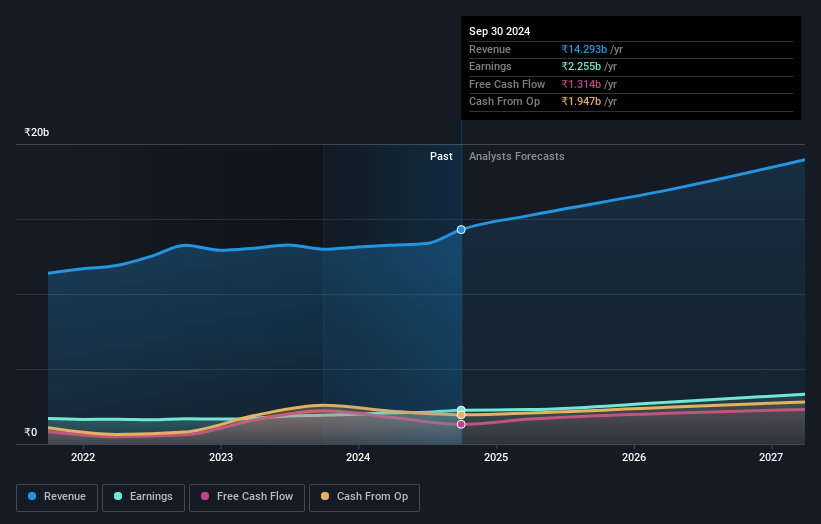

After the latest results, the one analyst covering Garware Technical Fibres are now predicting revenues of ₹15.2b in 2025. If met, this would reflect a reasonable 6.6% improvement in revenue compared to the last 12 months. Statutory per share are forecast to be ₹115, approximately in line with the last 12 months. Yet prior to the latest earnings, the analyst had been anticipated revenues of ₹14.4b and earnings per share (EPS) of ₹110 in 2025. It looks like there's been a modest increase in sentiment following the latest results, withthe analyst becoming a bit more optimistic in their predictions for both revenues and earnings.

With these upgrades, we're not surprised to see that the analyst has lifted their price target 14% to ₹4,600per share.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Garware Technical Fibres' past performance and to peers in the same industry. We can infer from the latest estimates that forecasts expect a continuation of Garware Technical Fibres'historical trends, as the 9.0% annualised revenue growth to the end of 2025 is roughly in line with the 8.9% annual growth over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenues grow 15% per year. So it's pretty clear that Garware Technical Fibres is expected to grow slower than similar companies in the same industry.

The Bottom Line

The most important thing here is that the analyst upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards Garware Technical Fibres following these results. They also upgraded their revenue estimates for next year, even though it is expected to grow slower than the wider industry. There was also a nice increase in the price target, with the analyst clearly feeling that the intrinsic value of the business is improving.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have analyst estimates for Garware Technical Fibres going out as far as 2027, and you can see them free on our platform here.

Another thing to consider is whether management and directors have been buying or selling stock recently. We provide an overview of all open market stock trades for the last twelve months on our platform, here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GARFIBRES

Garware Technical Fibres

Manufactures and sells various technical textile products in India and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026