The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Foce India (NSE:FOCE). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Foce India

How Fast Is Foce India Growing Its Earnings Per Share?

Foce India has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. Outstandingly, Foce India's EPS shot from ₹17.38 to ₹32.48, over the last year. Year on year growth of 87% is certainly a sight to behold. The best case scenario? That the business has hit a true inflection point.

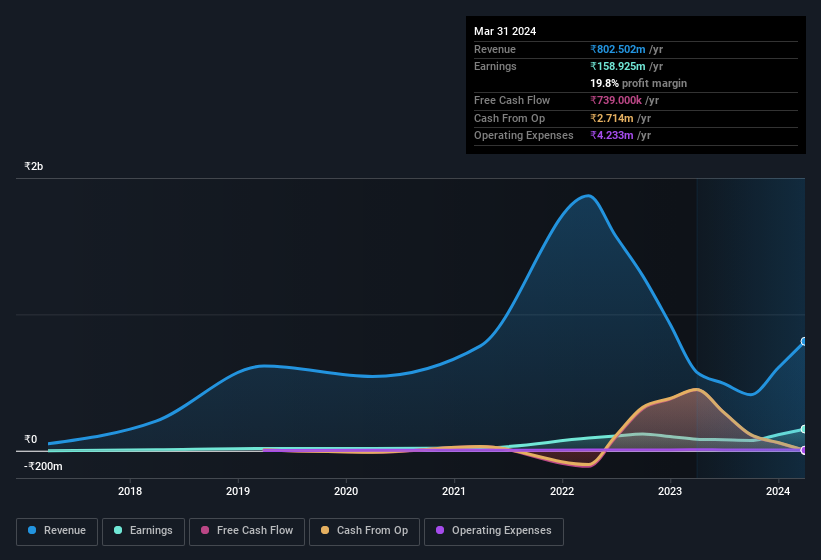

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Foce India is growing revenues, and EBIT margins improved by 6.6 percentage points to 25%, over the last year. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since Foce India is no giant, with a market capitalisation of ₹8.4b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Foce India Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we're pleased to report that Foce India insiders own a meaningful share of the business. To be exact, company insiders hold 74% of the company, so their decisions have a significant impact on their investments. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. With that sort of holding, insiders have about ₹6.2b riding on the stock, at current prices. So there's plenty there to keep them focused!

Does Foce India Deserve A Spot On Your Watchlist?

Foce India's earnings have taken off in quite an impressive fashion. That sort of growth is nothing short of eye-catching, and the large investment held by insiders should certainly brighten the view of the company. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. Based on the sum of its parts, we definitely think its worth watching Foce India very closely. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for Foce India (1 is a bit concerning) you should be aware of.

Although Foce India certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Indian companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:FOCE

Foce India

Manufactures, imports, and trades mens wrist watches under the FOCE brand in India.

Outstanding track record with adequate balance sheet.