- India

- /

- Consumer Durables

- /

- NSEI:ESFL

Essen Speciality Films Limited (NSE:ESFL) Shares Slammed 28% But Getting In Cheap Might Be Difficult Regardless

Essen Speciality Films Limited (NSE:ESFL) shares have had a horrible month, losing 28% after a relatively good period beforehand. The good news is that in the last year, the stock has shone bright like a diamond, gaining 209%.

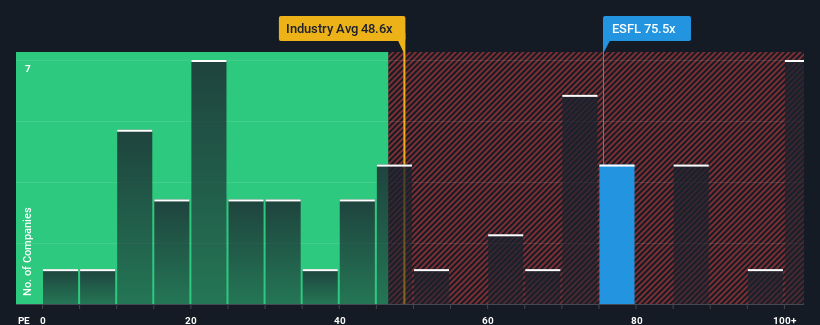

Although its price has dipped substantially, given close to half the companies in India have price-to-earnings ratios (or "P/E's") below 29x, you may still consider Essen Speciality Films as a stock to avoid entirely with its 75.5x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

As an illustration, earnings have deteriorated at Essen Speciality Films over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

See our latest analysis for Essen Speciality Films

Is There Enough Growth For Essen Speciality Films?

In order to justify its P/E ratio, Essen Speciality Films would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 14%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 159% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 25% shows it's noticeably more attractive on an annualised basis.

With this information, we can see why Essen Speciality Films is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Key Takeaway

Essen Speciality Films' shares may have retreated, but its P/E is still flying high. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Essen Speciality Films revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Essen Speciality Films with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on Essen Speciality Films, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Essen Speciality Films might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ESFL

Essen Speciality Films

Manufactures and exports specialized plastic products in India and internationally.

Adequate balance sheet very low.

Market Insights

Community Narratives