- India

- /

- Consumer Durables

- /

- NSEI:DIXON

3 Indian Growth Companies With Insider Ownership Up To 37%

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has remained flat, yet it has experienced a significant 40% increase over the past year, with earnings expected to grow by 17% annually in the coming years. In this context of robust growth potential, companies with high insider ownership often attract attention as they can indicate confidence from those closest to the business and align management's interests with shareholders.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.4% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 31.4% |

| Paisalo Digital (BSE:532900) | 16.3% | 24.8% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 32.3% |

| Rajratan Global Wire (BSE:517522) | 18.3% | 35.8% |

| KEI Industries (BSE:517569) | 19.2% | 21.9% |

| Pricol (NSEI:PRICOLLTD) | 25.5% | 24% |

| Aether Industries (NSEI:AETHER) | 31.1% | 45.8% |

Underneath we present a selection of stocks filtered out by our screen.

Dixon Technologies (India) (NSEI:DIXON)

Simply Wall St Growth Rating: ★★★★★★

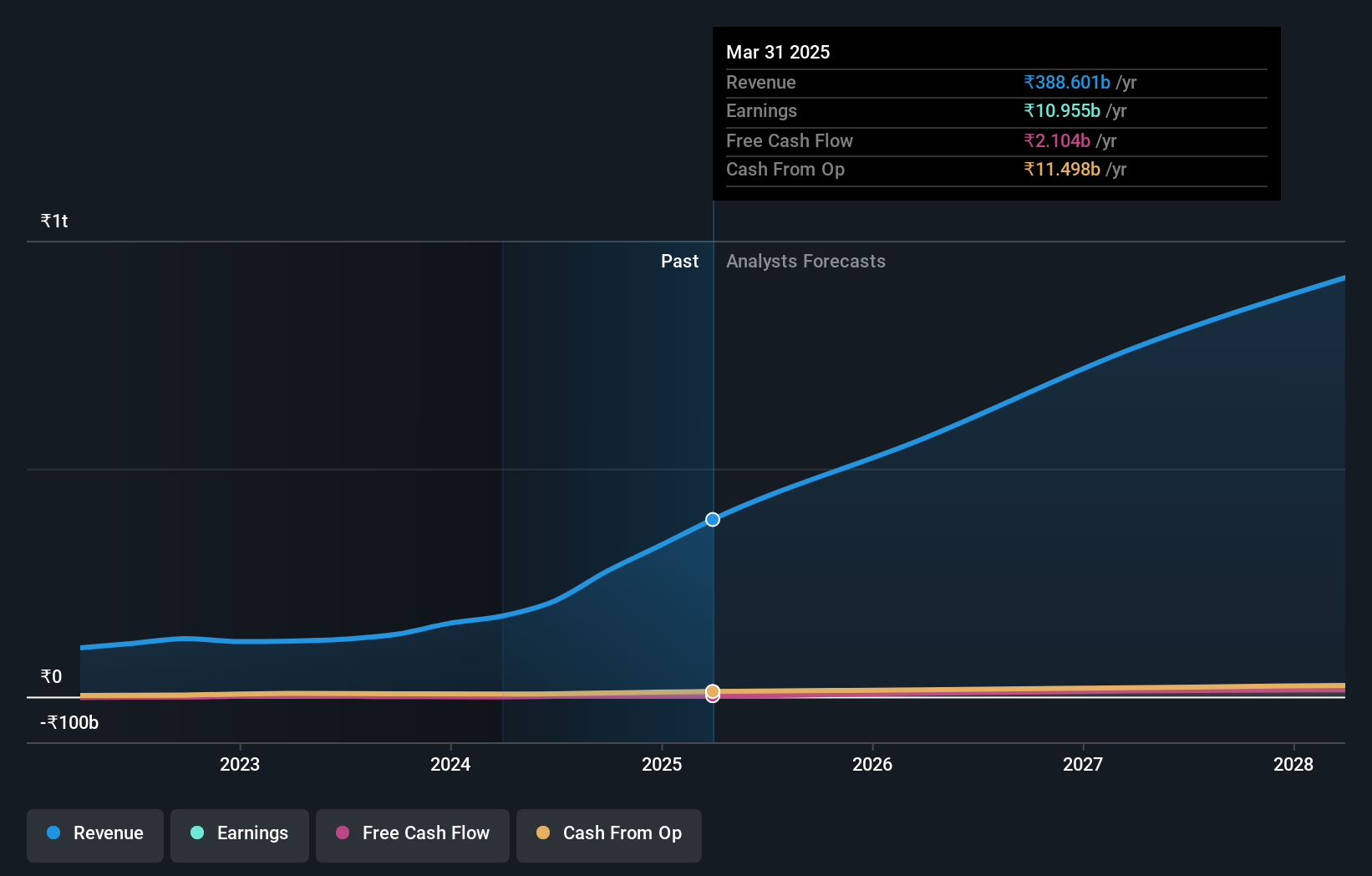

Overview: Dixon Technologies (India) Limited provides electronic manufacturing services both in India and internationally, with a market cap of ₹906.14 billion.

Operations: The company's revenue segments include Home Appliances at ₹12.51 billion, Lighting Products at ₹7.92 billion, Mobile & EMS Division at ₹143.16 billion, and Consumer Electronics & Appliances at ₹41.21 billion.

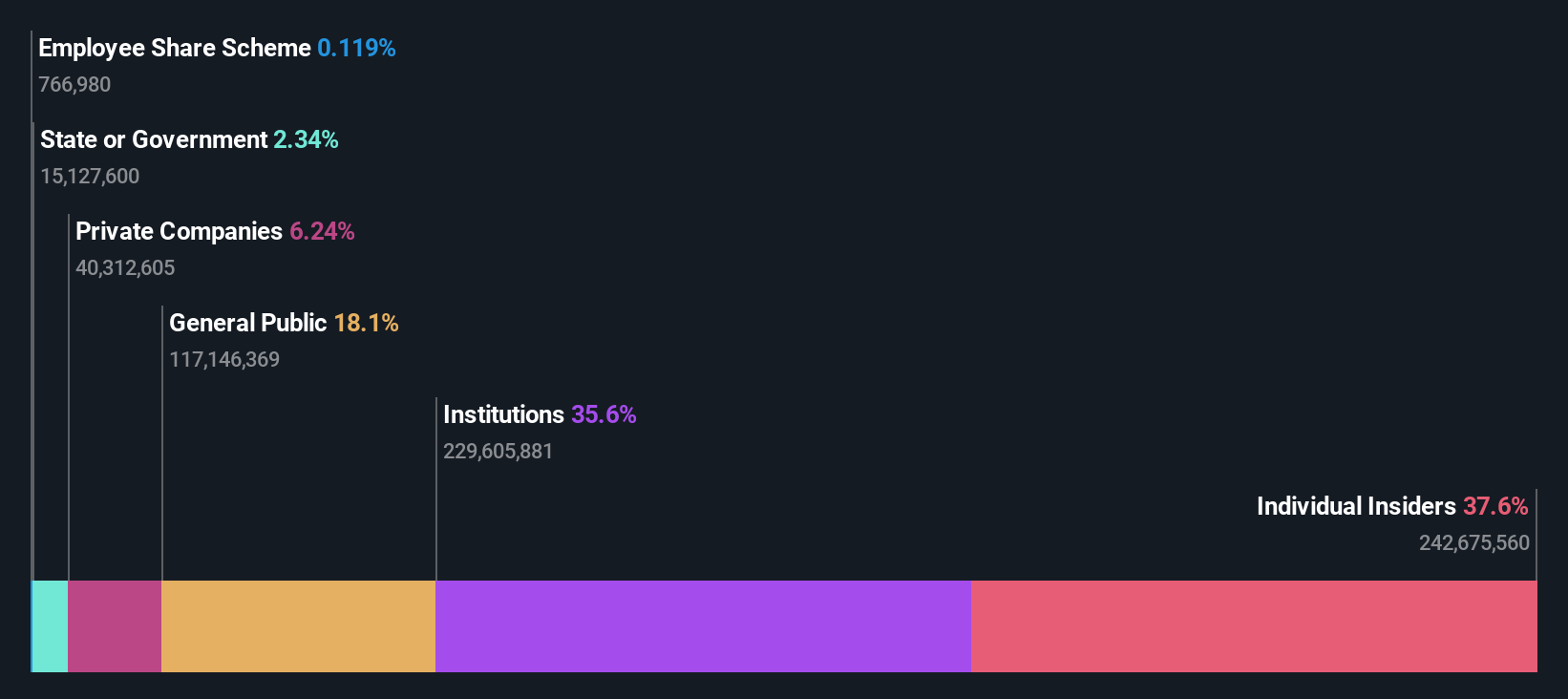

Insider Ownership: 24.6%

Dixon Technologies (India) demonstrates strong growth potential with its earnings forecasted to grow significantly at 31.4% annually, outpacing the Indian market. Revenue is also expected to rise by 23.9% per year, surpassing market averages. Recent financial results show robust performance, with Q1 sales doubling from last year to ₹65.80 billion and net income increasing substantially. The company has maintained high insider ownership without substantial insider trading activity in recent months, indicating confidence in its trajectory.

- Click here and access our complete growth analysis report to understand the dynamics of Dixon Technologies (India).

- Our comprehensive valuation report raises the possibility that Dixon Technologies (India) is priced higher than what may be justified by its financials.

Info Edge (India) (NSEI:NAUKRI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Info Edge (India) Limited is an online classifieds company that provides services in recruitment, matrimony, real estate, and education both in India and internationally, with a market cap of ₹1.08 trillion.

Operations: The company's revenue segments include ₹19.05 billion from Recruitment Solutions and ₹3.67 billion from 99acres for Real Estate.

Insider Ownership: 37.7%

Info Edge (India) shows promising growth potential with earnings projected to increase significantly at 23.6% annually, surpassing the Indian market average. Despite a slower revenue growth forecast of 13%, it still outpaces the market. Recent financial results reflect strong performance, with Q1 net income rising to ₹2.33 billion from ₹1.59 billion last year. The company has maintained high insider ownership without substantial recent insider trading, indicating confidence in its future prospects.

- Navigate through the intricacies of Info Edge (India) with our comprehensive analyst estimates report here.

- The analysis detailed in our Info Edge (India) valuation report hints at an inflated share price compared to its estimated value.

One97 Communications (NSEI:PAYTM)

Simply Wall St Growth Rating: ★★★★☆☆

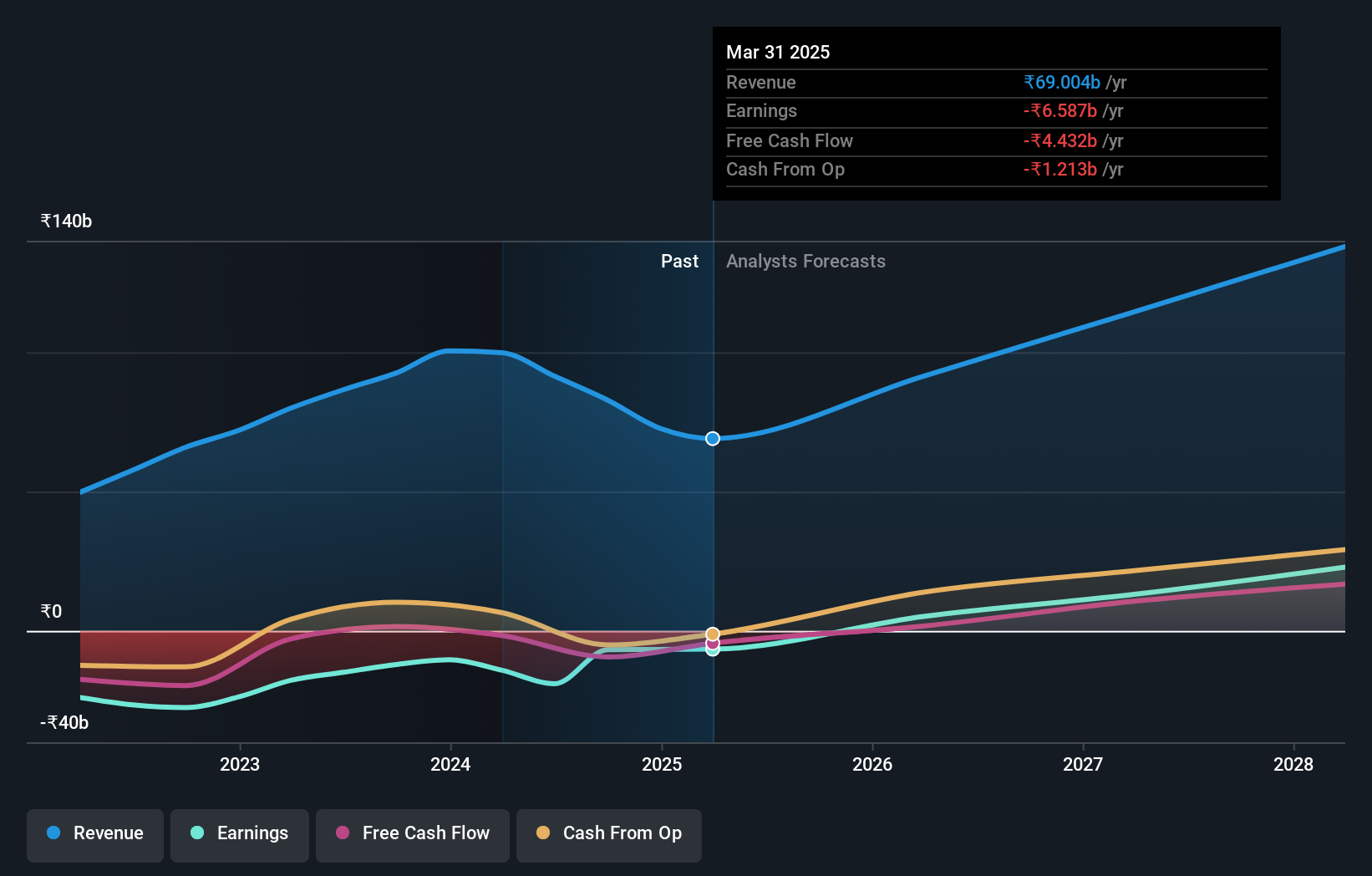

Overview: One97 Communications Limited operates in India, offering payment, commerce and cloud, and financial services to consumers and merchants with a market cap of ₹4.61 billion.

Operations: The company's revenue is primarily derived from its data processing segment, which generated ₹91.38 billion.

Insider Ownership: 20.7%

One97 Communications, owner of Paytm, is projected to achieve profitability within three years, with earnings expected to grow 64.5% annually. Despite a slower revenue growth forecast of 12.1%, it surpasses the Indian market average. Recent strategic moves include selling its entertainment ticketing business for ₹20.48 billion and expanding digital payment solutions in agricultural markets, enhancing operational efficiency and financial inclusivity for farmers and traders in Madhya Pradesh's Krishi Mandis.

- Unlock comprehensive insights into our analysis of One97 Communications stock in this growth report.

- The valuation report we've compiled suggests that One97 Communications' current price could be inflated.

Turning Ideas Into Actions

- Navigate through the entire inventory of 90 Fast Growing Indian Companies With High Insider Ownership here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Dixon Technologies (India), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:DIXON

Dixon Technologies (India)

Engages in the provision of electronic manufacturing services in India and internationally.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives