- India

- /

- Diversified Financial

- /

- NSEI:PAYTM

3 Growth Companies With High Insider Ownership On Indian Exchanges Featuring 23% Revenue Growth

Reviewed by Simply Wall St

The Indian market remained flat over the last week but has surged 45% over the past year, with earnings expected to grow by 17% annually. In this favorable environment, growth companies with high insider ownership can be particularly attractive as they often signal strong internal confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 36% |

| Kirloskar Pneumatic (BSE:505283) | 30.6% | 30.1% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 35.5% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.2% |

| Shivalik Bimetal Controls (BSE:513097) | 19.5% | 28.7% |

| Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 31.9% | 20.7% |

| Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

| JNK India (NSEI:JNKINDIA) | 20.9% | 31.8% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 33% |

| Pricol (NSEI:PRICOLLTD) | 25.5% | 24% |

Underneath we present a selection of stocks filtered out by our screen.

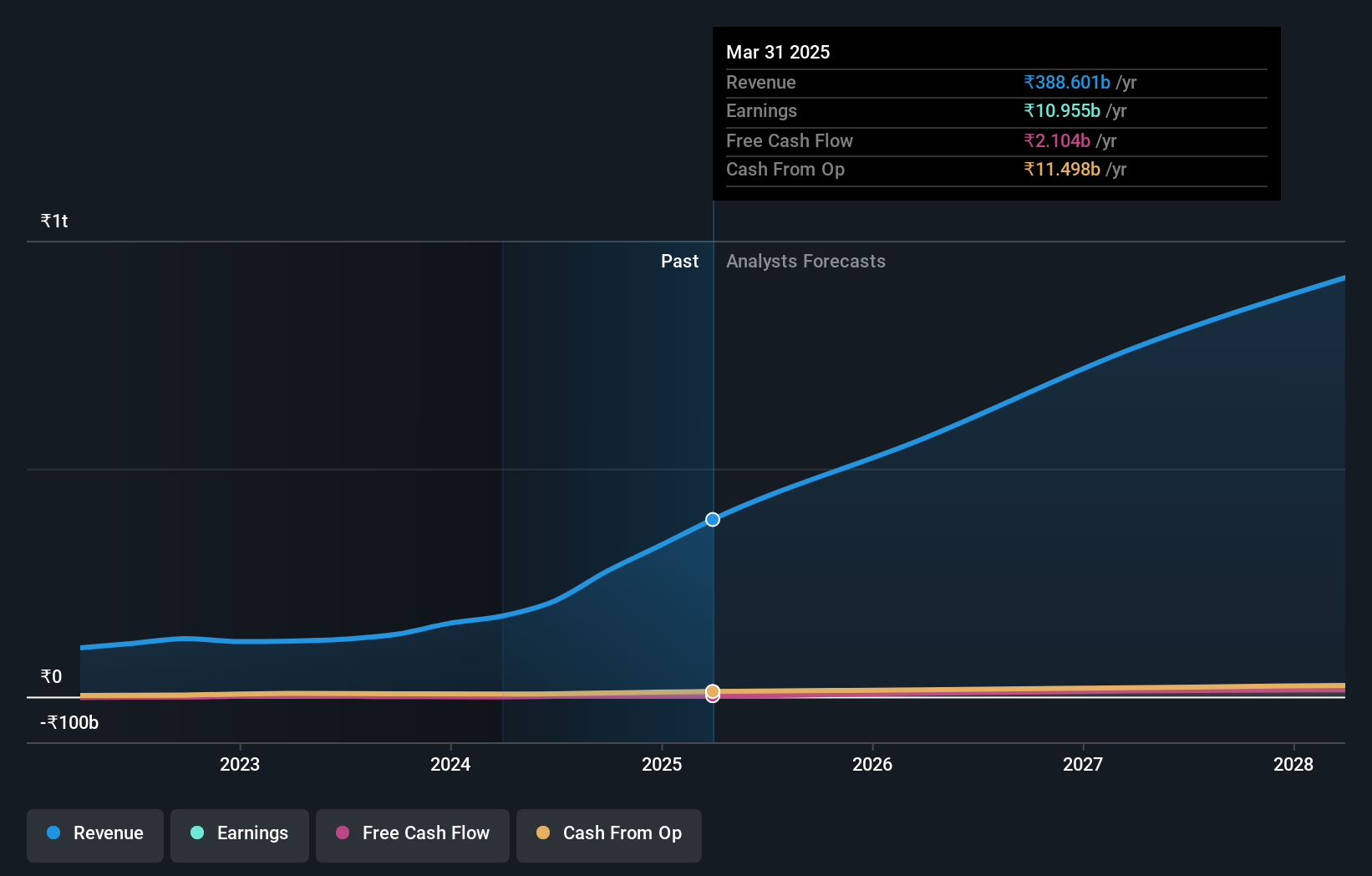

Dixon Technologies (India) (NSEI:DIXON)

Simply Wall St Growth Rating: ★★★★★★

Overview: Dixon Technologies (India) Limited provides electronic manufacturing services in India and has a market cap of ₹697.35 billion.

Operations: Dixon Technologies (India) Limited generates revenue from various segments including Home Appliances (₹12.51 billion), Lighting Products (₹7.92 billion), Mobile & EMS Division (₹143.16 billion), and Consumer Electronics & Appliances (₹41.21 billion).

Insider Ownership: 24.6%

Revenue Growth Forecast: 23.4% p.a.

Dixon Technologies (India) has demonstrated significant growth, with earnings increasing by 55.3% over the past year and revenue doubling to ₹65.88 billion for Q1 2024 compared to the previous year. Earnings are forecasted to grow at 35.54% annually, significantly outpacing market expectations. The company’s high insider ownership aligns management interests with shareholders, reinforcing its position as a promising growth company in India's expanding market for consumer electronics manufacturing.

- Take a closer look at Dixon Technologies (India)'s potential here in our earnings growth report.

- The valuation report we've compiled suggests that Dixon Technologies (India)'s current price could be inflated.

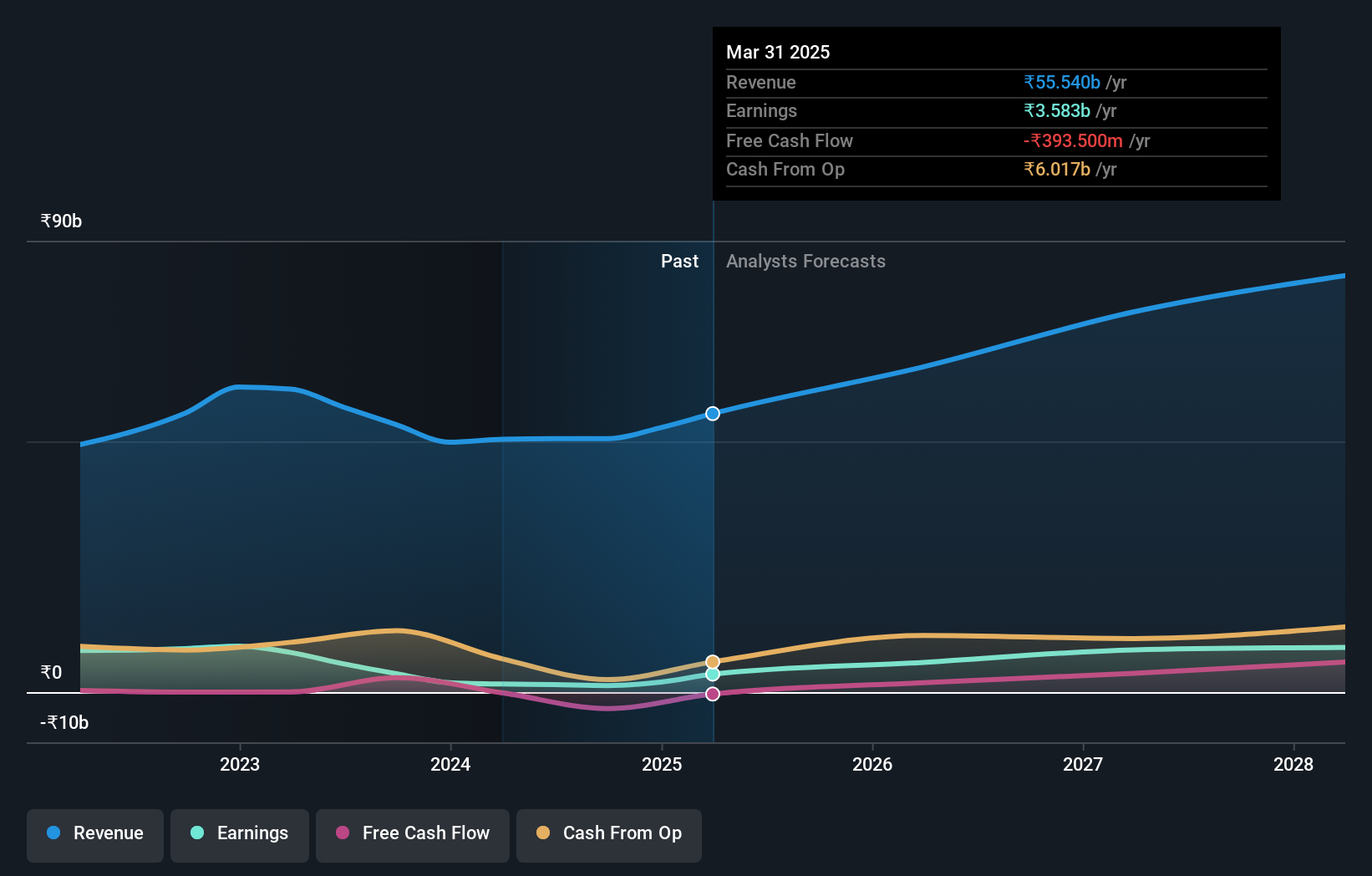

Laurus Labs (NSEI:LAURUSLABS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Laurus Labs Limited, with a market cap of ₹241.06 billion, manufactures and sells medicines and active pharmaceutical ingredients (APIs) in India and internationally.

Operations: The company's revenue from the manufacture of active pharmaceutical ingredients, intermediates, and formulations is ₹50.54 billion.

Insider Ownership: 27.8%

Revenue Growth Forecast: 13.9% p.a.

Laurus Labs has seen a decline in profit margins from 9.9% to 2.9% over the past year, with recent Q1 earnings showing net income of ₹125.1 million compared to ₹248.5 million a year ago. However, its earnings are forecasted to grow significantly at 50.8% annually, outpacing the Indian market's average growth rate of 16.7%. The company also recently entered a strategic alliance with Willow Biosciences for sustainable API manufacturing, potentially enhancing long-term growth prospects despite current financial challenges.

- Unlock comprehensive insights into our analysis of Laurus Labs stock in this growth report.

- Upon reviewing our latest valuation report, Laurus Labs' share price might be too optimistic.

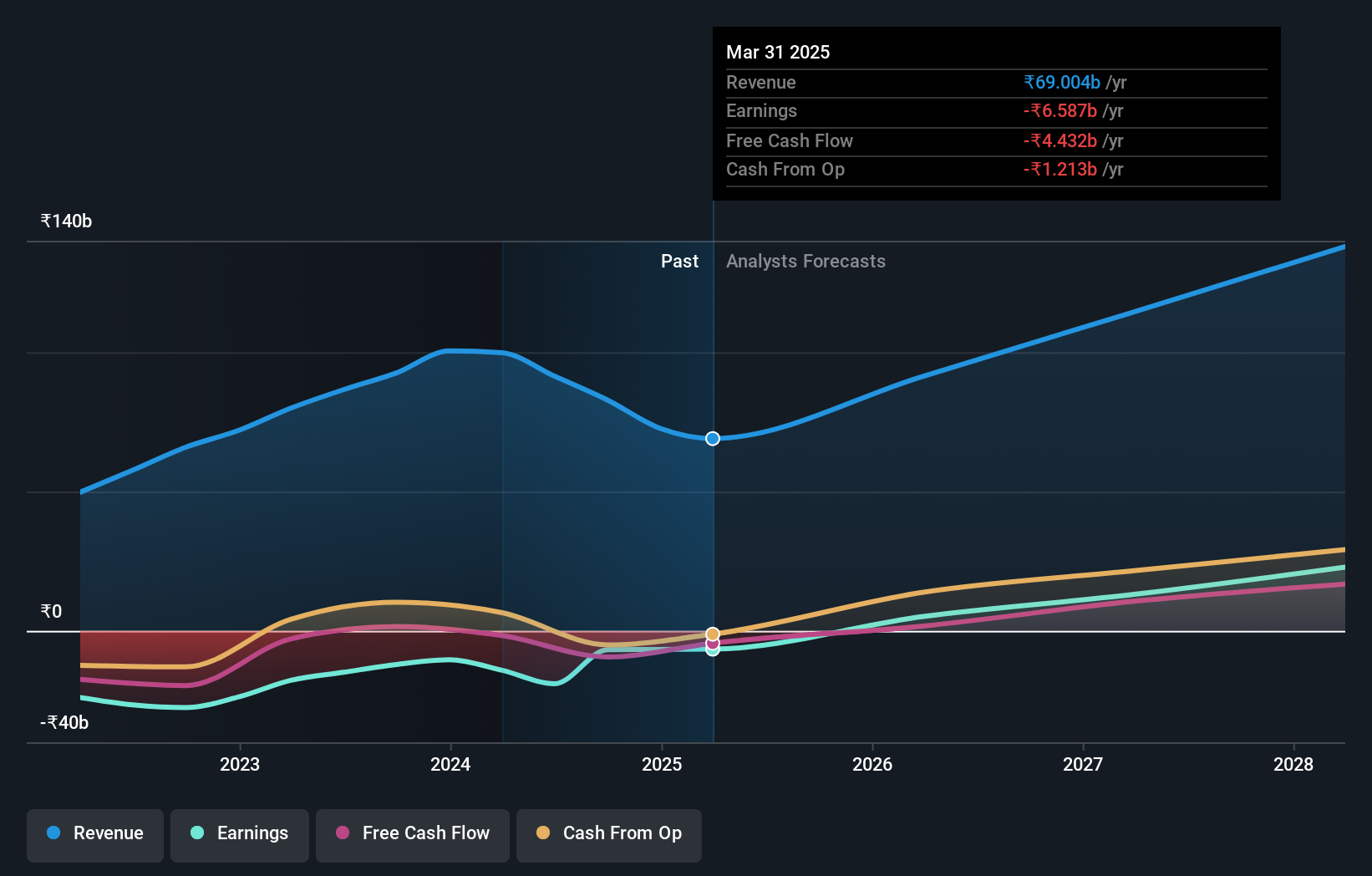

One97 Communications (NSEI:PAYTM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: One97 Communications Limited offers payment, commerce and cloud, and financial services to consumers and merchants in India, with a market cap of ₹335.32 billion.

Operations: The company's revenue segments include Data Processing, which generated ₹91.38 billion.

Insider Ownership: 20.7%

Revenue Growth Forecast: 11.4% p.a.

One97 Communications, the parent company of Paytm, has seen substantial insider ownership and is poised for growth despite recent financial challenges. The company reported a significant net loss in Q1 2024 but is forecasted to become profitable within three years. Recent strategic moves include a partnership with FlixBus to enhance travel services and the launch of 'Paytm Health Saathi' for merchant partners. However, regulatory penalties and ongoing M&A discussions may impact short-term performance.

- Dive into the specifics of One97 Communications here with our thorough growth forecast report.

- Our valuation report here indicates One97 Communications may be undervalued.

Taking Advantage

- Unlock more gems! Our Fast Growing Indian Companies With High Insider Ownership screener has unearthed 87 more companies for you to explore.Click here to unveil our expertly curated list of 90 Fast Growing Indian Companies With High Insider Ownership.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:PAYTM

One97 Communications

Provides payment, commerce and cloud, and financial services to consumers and merchants in India, the United Arab Emirates, Saudi Arabia, and Singapore.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives