- India

- /

- Consumer Durables

- /

- NSEI:CROMPTON

Investors one-year losses continue as Crompton Greaves Consumer Electricals (NSE:CROMPTON) dips a further 4.7% this week, earnings continue to decline

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. That downside risk was realized by Crompton Greaves Consumer Electricals Limited (NSE:CROMPTON) shareholders over the last year, as the share price declined 37%. That contrasts poorly with the market decline of 1.7%. However, the longer term returns haven't been so bad, with the stock down 28% in the last three years. The falls have accelerated recently, with the share price down 22% in the last three months.

After losing 4.7% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

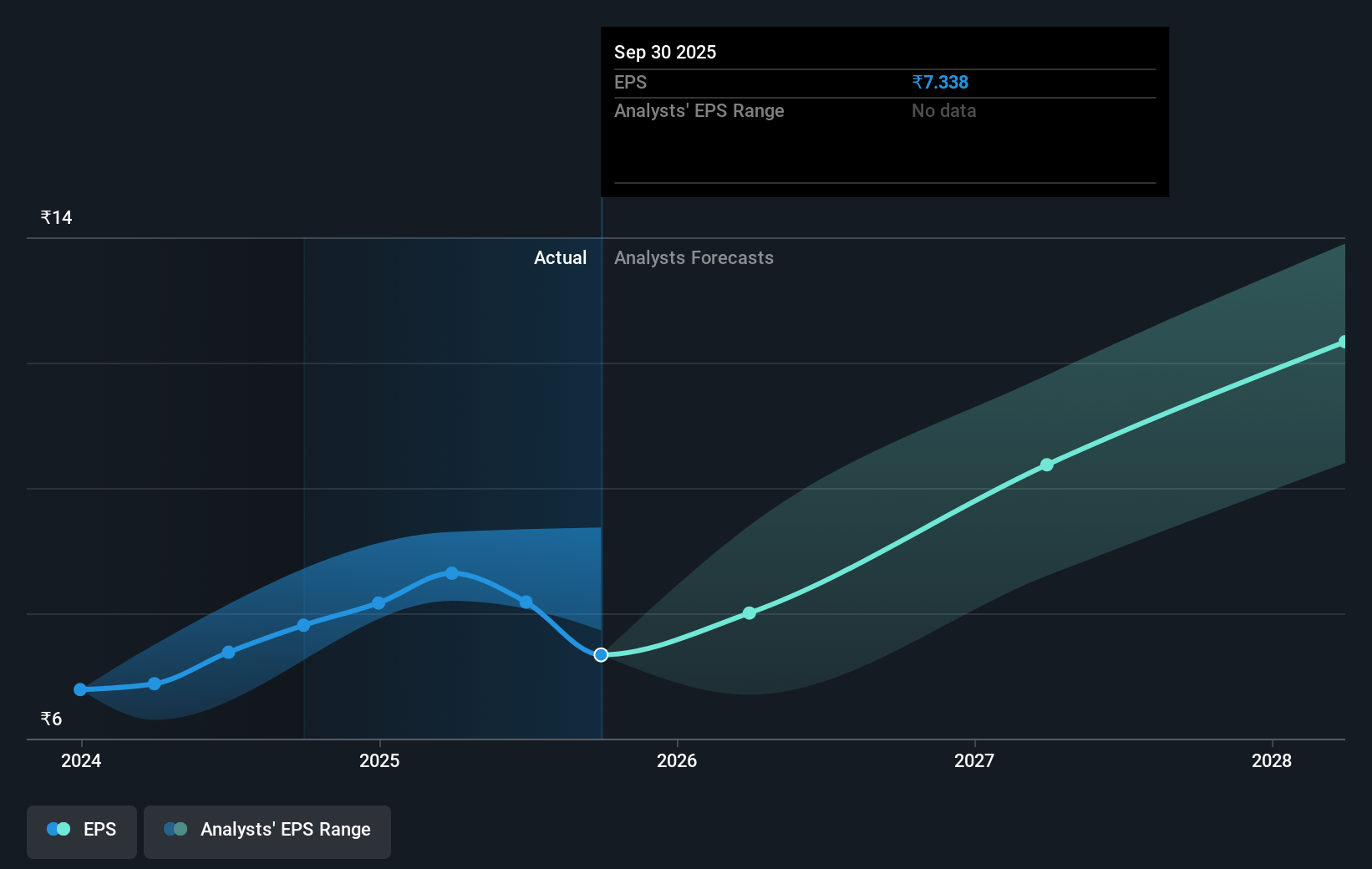

Unfortunately Crompton Greaves Consumer Electricals reported an EPS drop of 6.0% for the last year. The share price decline of 37% is actually more than the EPS drop. So it seems the market was too confident about the business, a year ago.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Crompton Greaves Consumer Electricals' key metrics by checking this interactive graph of Crompton Greaves Consumer Electricals's earnings, revenue and cash flow.

A Different Perspective

Investors in Crompton Greaves Consumer Electricals had a tough year, with a total loss of 37% (including dividends), against a market gain of about 1.7%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 4% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Crompton Greaves Consumer Electricals better, we need to consider many other factors. For example, we've discovered 1 warning sign for Crompton Greaves Consumer Electricals that you should be aware of before investing here.

Of course Crompton Greaves Consumer Electricals may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CROMPTON

Crompton Greaves Consumer Electricals

Manufactures and markets consumer electrical products in India.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026