Not Many Are Piling Into Akshar Spintex Limited (NSE:AKSHAR) Stock Yet As It Plummets 32%

To the annoyance of some shareholders, Akshar Spintex Limited (NSE:AKSHAR) shares are down a considerable 32% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 75% share price decline.

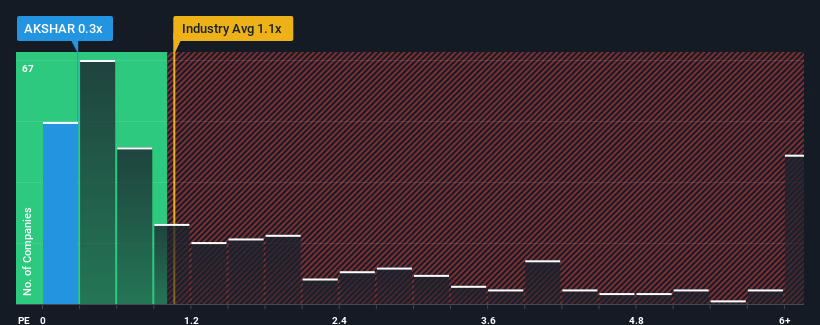

Following the heavy fall in price, considering around half the companies operating in India's Luxury industry have price-to-sales ratios (or "P/S") above 1.1x, you may consider Akshar Spintex as an solid investment opportunity with its 0.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Akshar Spintex

What Does Akshar Spintex's P/S Mean For Shareholders?

Akshar Spintex certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Akshar Spintex will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

Akshar Spintex's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 38%. Pleasingly, revenue has also lifted 41% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

It's interesting to note that the rest of the industry is similarly expected to grow by 13% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this in consideration, we find it intriguing that Akshar Spintex's P/S falls short of its industry peers. It may be that most investors are not convinced the company can maintain recent growth rates.

The Final Word

Akshar Spintex's P/S has taken a dip along with its share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Akshar Spintex revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. medium-term

Before you settle on your opinion, we've discovered 4 warning signs for Akshar Spintex (2 are significant!) that you should be aware of.

If these risks are making you reconsider your opinion on Akshar Spintex, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:AKSHAR

Akshar Spintex

Engages in the spinning, manufacture, and sale of cotton yarns in India.

Adequate balance sheet with very low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026