- India

- /

- Professional Services

- /

- NSEI:FSL

Has Firstsource Solutions Limited's (NSE:FSL) Impressive Stock Performance Got Anything to Do With Its Fundamentals?

Firstsource Solutions' (NSE:FSL) stock is up by a considerable 65% over the past three months. As most would know, fundamentals are what usually guide market price movements over the long-term, so we decided to look at the company's key financial indicators today to determine if they have any role to play in the recent price movement. In this article, we decided to focus on Firstsource Solutions' ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Put another way, it reveals the company's success at turning shareholder investments into profits.

Check out our latest analysis for Firstsource Solutions

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Firstsource Solutions is:

14% = ₹5.2b ÷ ₹37b (Based on the trailing twelve months to June 2024).

The 'return' is the amount earned after tax over the last twelve months. Another way to think of that is that for every ₹1 worth of equity, the company was able to earn ₹0.14 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Firstsource Solutions' Earnings Growth And 14% ROE

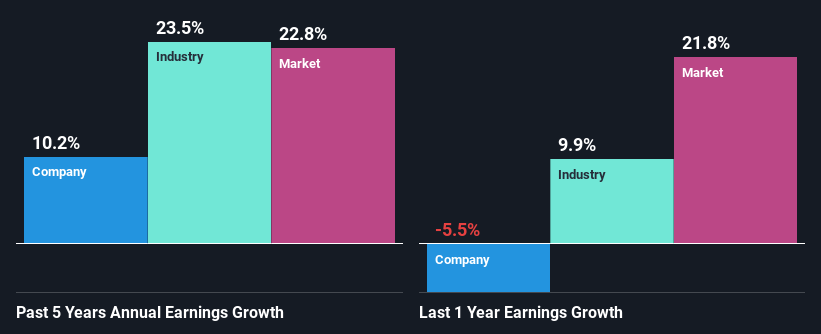

At first glance, Firstsource Solutions' ROE doesn't look very promising. However, the fact that the company's ROE is higher than the average industry ROE of 11%, is definitely interesting. This probably goes some way in explaining Firstsource Solutions' moderate 10% growth over the past five years amongst other factors. Bear in mind, the company does have a moderately low ROE. It is just that the industry ROE is lower. So there might well be other reasons for the earnings to grow. Such as- high earnings retention or the company belonging to a high growth industry.

We then compared Firstsource Solutions' net income growth with the industry and found that the company's growth figure is lower than the average industry growth rate of 24% in the same 5-year period, which is a bit concerning.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. What is FSL worth today? The intrinsic value infographic in our free research report helps visualize whether FSL is currently mispriced by the market.

Is Firstsource Solutions Using Its Retained Earnings Effectively?

Firstsource Solutions has a three-year median payout ratio of 47%, which implies that it retains the remaining 53% of its profits. This suggests that its dividend is well covered, and given the decent growth seen by the company, it looks like management is reinvesting its earnings efficiently.

Additionally, Firstsource Solutions has paid dividends over a period of six years which means that the company is pretty serious about sharing its profits with shareholders. Our latest analyst data shows that the future payout ratio of the company is expected to drop to 37% over the next three years. Accordingly, the expected drop in the payout ratio explains the expected increase in the company's ROE to 21%, over the same period.

Conclusion

In total, it does look like Firstsource Solutions has some positive aspects to its business. Specifically, we like that the company is reinvesting a huge chunk of its profits at a respectable rate of return. This of course has caused the company to see a good amount of growth in its earnings. Having said that, looking at the current analyst estimates, we found that the company's earnings are expected to gain momentum. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:FSL

Firstsource Solutions

Provides tech-enabled business processes in India, the United Kingdom, the United States, the United Arab Emirates, and internationally.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026