- India

- /

- Professional Services

- /

- NSEI:ECLERX

There Is A Reason eClerx Services Limited's (NSE:ECLERX) Price Is Undemanding

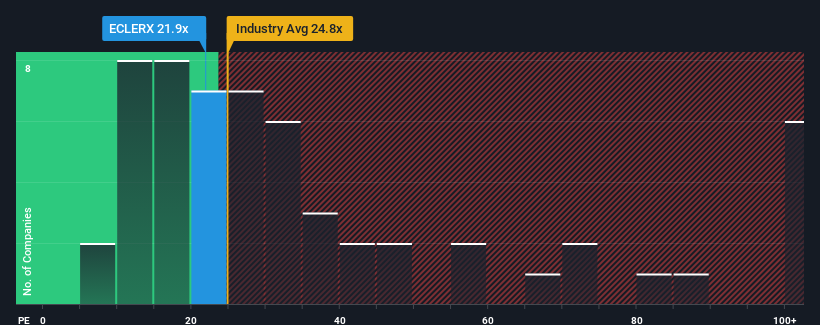

When close to half the companies in India have price-to-earnings ratios (or "P/E's") above 30x, you may consider eClerx Services Limited (NSE:ECLERX) as an attractive investment with its 21.9x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings growth that's inferior to most other companies of late, eClerx Services has been relatively sluggish. The P/E is probably low because investors think this lacklustre earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for eClerx Services

Is There Any Growth For eClerx Services?

There's an inherent assumption that a company should underperform the market for P/E ratios like eClerx Services' to be considered reasonable.

Retrospectively, the last year delivered a decent 7.5% gain to the company's bottom line. The latest three year period has also seen an excellent 95% overall rise in EPS, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 13% per annum during the coming three years according to the eight analysts following the company. Meanwhile, the rest of the market is forecast to expand by 21% each year, which is noticeably more attractive.

In light of this, it's understandable that eClerx Services' P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of eClerx Services' analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for eClerx Services with six simple checks on some of these key factors.

If you're unsure about the strength of eClerx Services' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ECLERX

eClerx Services

Provides business process management, change management, data-driven insights, and advanced analytics services in India, the United States, the United Kingdom, Europe, and the Asia Pacific.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives