- India

- /

- Professional Services

- /

- NSEI:CAMS

Computer Age Management Services Limited's (NSE:CAMS) Shares May Have Run Too Fast Too Soon

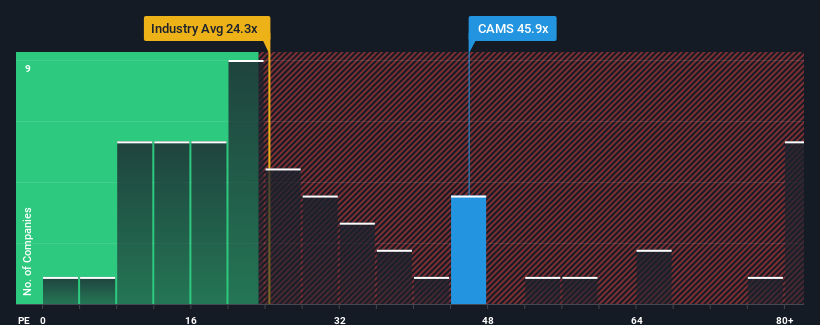

When close to half the companies in India have price-to-earnings ratios (or "P/E's") below 30x, you may consider Computer Age Management Services Limited (NSE:CAMS) as a stock to avoid entirely with its 45.9x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Recent earnings growth for Computer Age Management Services has been in line with the market. It might be that many expect the mediocre earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Computer Age Management Services

Is There Enough Growth For Computer Age Management Services?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Computer Age Management Services' to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 24%. The strong recent performance means it was also able to grow EPS by 71% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 15% each year as estimated by the twelve analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 21% per annum, which is noticeably more attractive.

With this information, we find it concerning that Computer Age Management Services is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Computer Age Management Services' P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Computer Age Management Services' analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Before you take the next step, you should know about the 2 warning signs for Computer Age Management Services that we have uncovered.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CAMS

Computer Age Management Services

A mutual fund transfer agency, provides services to private equity funds, and banks and non-banking finance companies in India.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives