- India

- /

- Professional Services

- /

- NSEI:CAMS

Computer Age Management Services Limited (NSE:CAMS) Investors Are Less Pessimistic Than Expected

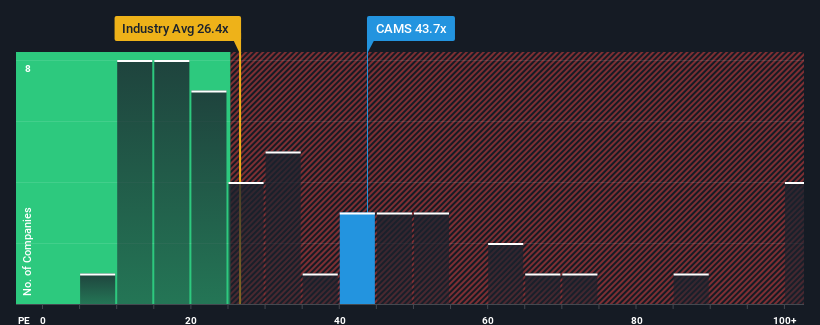

With a price-to-earnings (or "P/E") ratio of 43.7x Computer Age Management Services Limited (NSE:CAMS) may be sending bearish signals at the moment, given that almost half of all companies in India have P/E ratios under 30x and even P/E's lower than 17x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Recent times haven't been advantageous for Computer Age Management Services as its earnings have been rising slower than most other companies. One possibility is that the P/E is high because investors think this lacklustre earnings performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

View our latest analysis for Computer Age Management Services

Is There Enough Growth For Computer Age Management Services?

In order to justify its P/E ratio, Computer Age Management Services would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered a decent 7.1% gain to the company's bottom line. Pleasingly, EPS has also lifted 71% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 15% per annum as estimated by the nine analysts watching the company. That's shaping up to be materially lower than the 19% per year growth forecast for the broader market.

In light of this, it's alarming that Computer Age Management Services' P/E sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Computer Age Management Services currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Computer Age Management Services that you need to be mindful of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CAMS

Computer Age Management Services

A mutual fund transfer agency, provides services to private equity funds, and banks and non-banking finance companies in India.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives