- India

- /

- Electrical

- /

- NSEI:ZODIAC

Optimistic Investors Push Zodiac Energy Limited (NSE:ZODIAC) Shares Up 26% But Growth Is Lacking

Zodiac Energy Limited (NSE:ZODIAC) shares have continued their recent momentum with a 26% gain in the last month alone. This latest share price bounce rounds out a remarkable 517% gain over the last twelve months.

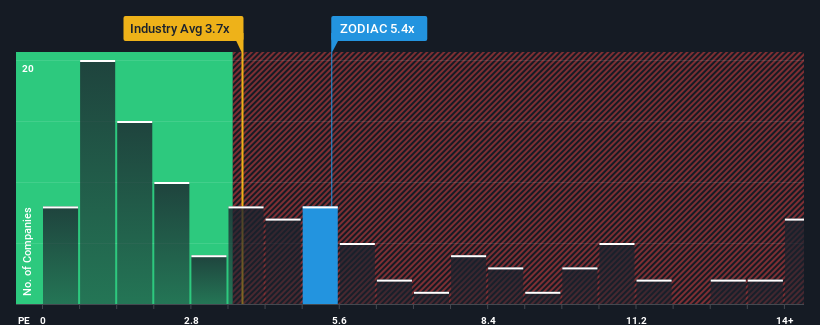

Since its price has surged higher, Zodiac Energy may be sending bearish signals at the moment with its price-to-sales (or "P/S") ratio of 5.4x, since almost half of all companies in the Electrical in India have P/S ratios under 3.7x and even P/S lower than 1.5x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Zodiac Energy

How Has Zodiac Energy Performed Recently?

Recent times have been quite advantageous for Zodiac Energy as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Zodiac Energy will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Zodiac Energy's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 60% gain to the company's top line. Pleasingly, revenue has also lifted 119% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 31% shows it's about the same on an annualised basis.

In light of this, it's curious that Zodiac Energy's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as a continuation of recent revenue trends would weigh down the share price eventually.

The Key Takeaway

Zodiac Energy shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Zodiac Energy has shown that it currently trades on a higher than expected P/S since its recent three-year growth is only in line with the wider industry forecast. Right now we are uncomfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 1 warning sign for Zodiac Energy you should be aware of.

If these risks are making you reconsider your opinion on Zodiac Energy, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Zodiac Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:ZODIAC

Zodiac Energy

Engages in the installation of solar power generation plants and related items primarily in India.

Slight with acceptable track record.

Similar Companies

Market Insights

Community Narratives